How to Add New KRRX Token to Your Trust Wallet

In this article, we will provide a step- by-step guide to adding the new KRRX token on Trust Wallet app and converting all your old KRRX tokens on Trust Wallet to the new token.

How to Add the New KRRX Token to Trust Wallet

On January 12, 2023, the KRRX token migrated to a new contract address. This move, or rather upgrade, tightened up the token code to make it more secure and impregnable to all known threats. All minted and circulating KRRX tokens across all platforms will move to this new address.

KRRX is the native token that serves a popular exchange, Kyrrex. It will also, with time, serve a wide ecosystem. Hence, it's a very popular coin held by many users on exchanges like Kyrrex, HiBtc and Huobi, and also in non custodial wallets. If you're one of those holding KRRX in Trust Wallet, this guide will show you the steps to add the new KRRX tokens to your personal wallet. We will also show you how to convert your old KRRX holdings to coins using the new contract.

Part 1: Deposit Your Trust Wallet KRRX Tokens to Kyrrex

If you hold KRRX in Trust Wallet (and any other non custodial app), you first of all need to exchange your old coins with the new ones. The only place to do this is on Kyrrex.com, the Kyrrex app, or @krrx_bot on Telegram.

Here's how to use Kyrrex.com to deposit your old KRRX tokens.

Step 1: Visit Kyrrex.com in your browser.

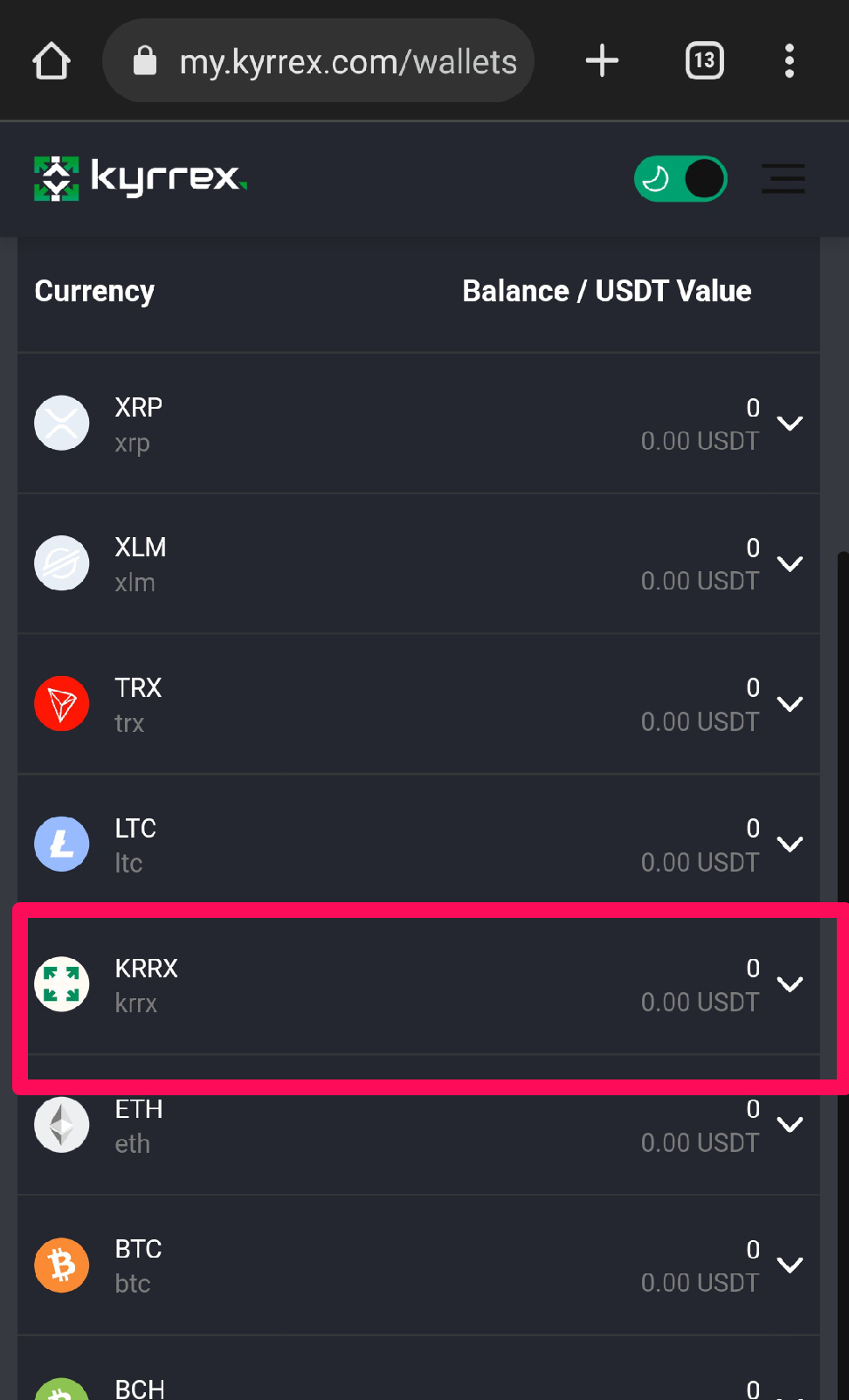

Step 2: Log into your Kyrrex account and navigate to Wallet.

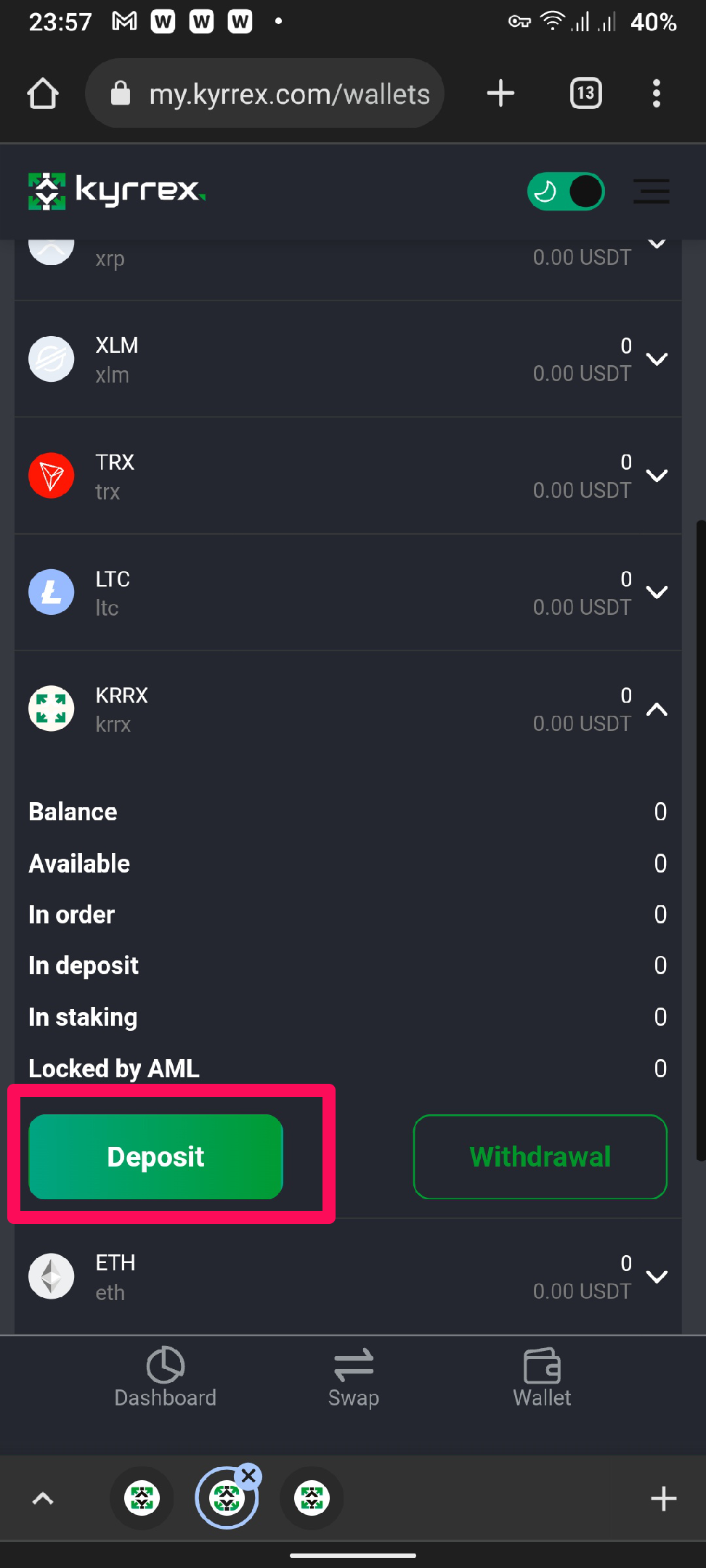

Step 3: Select KRRX in the currency list.

Step 4: Click Deposit.

Step 5: On the next screen, copy the deposit address for KRRX Token OLD.

IMPORTANT❗

Make sure you're copying the deposit address for KRRX Token OLD. The contract address for the old KRRX token and the new KRRX token are different.

Step 6: Now open your Trust Wallet app.

Step 7: Select Kyrrex and click Send.

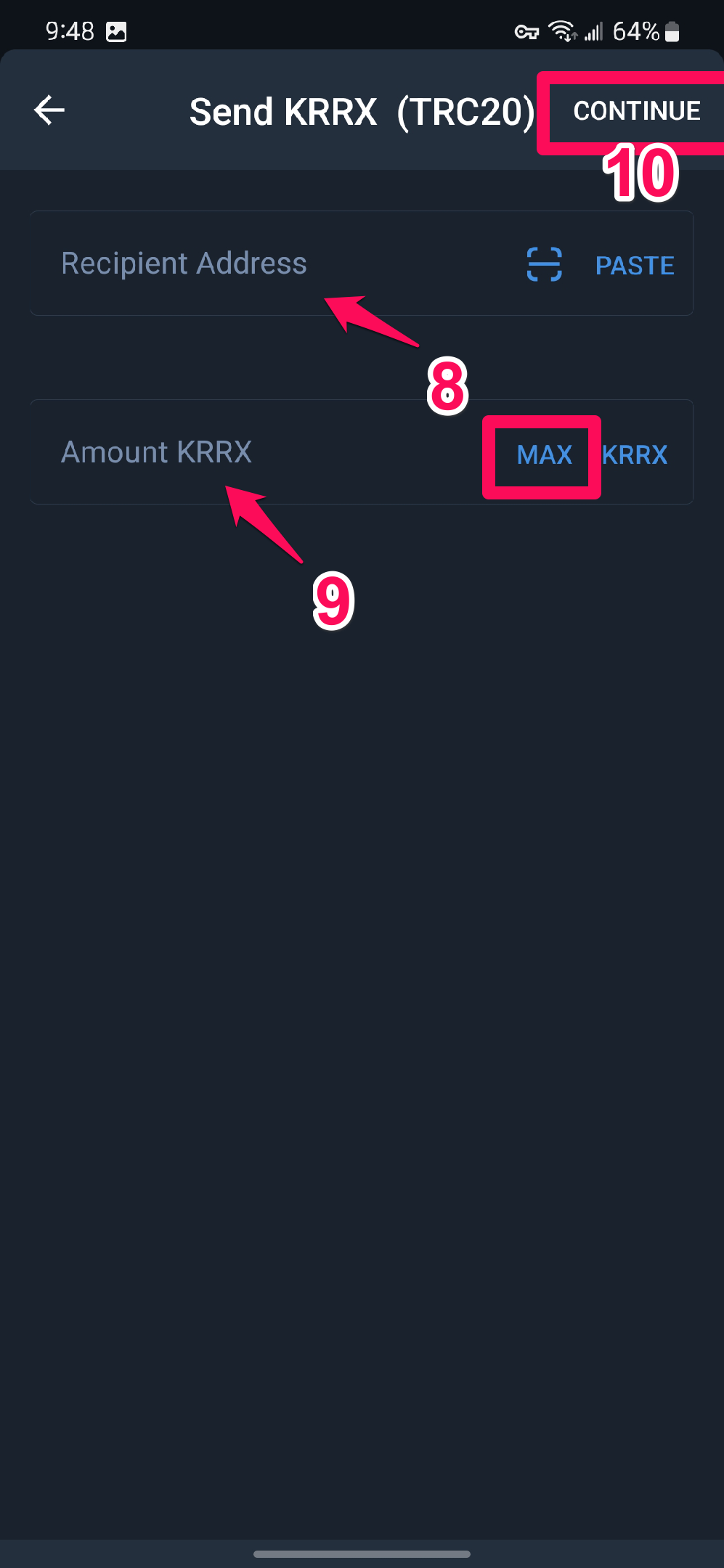

Step 8: Paste the copied address in the Recipient Address field.

Step 9: Enter the amount of KRRX you wish to send in the Amount KRRX field. If you wish to send everything (this is strongly recommended) click MAX.

Step 10: Hit Continue and then click CONFIRM on the next screen to finish the deposit.

IMPORTANT❗

KRRX is a TRC20 token. So make sure you have some Tron in your wallet for gas fees.

Part 2: Remove the Old KRRX Entry From Your Trust Wallet Screen

You are going to be adding the new KRRX token to Trust Wallet soon. To avoid confusion, we recommend removing the old Kyrrex entry first. Here's how to do it.

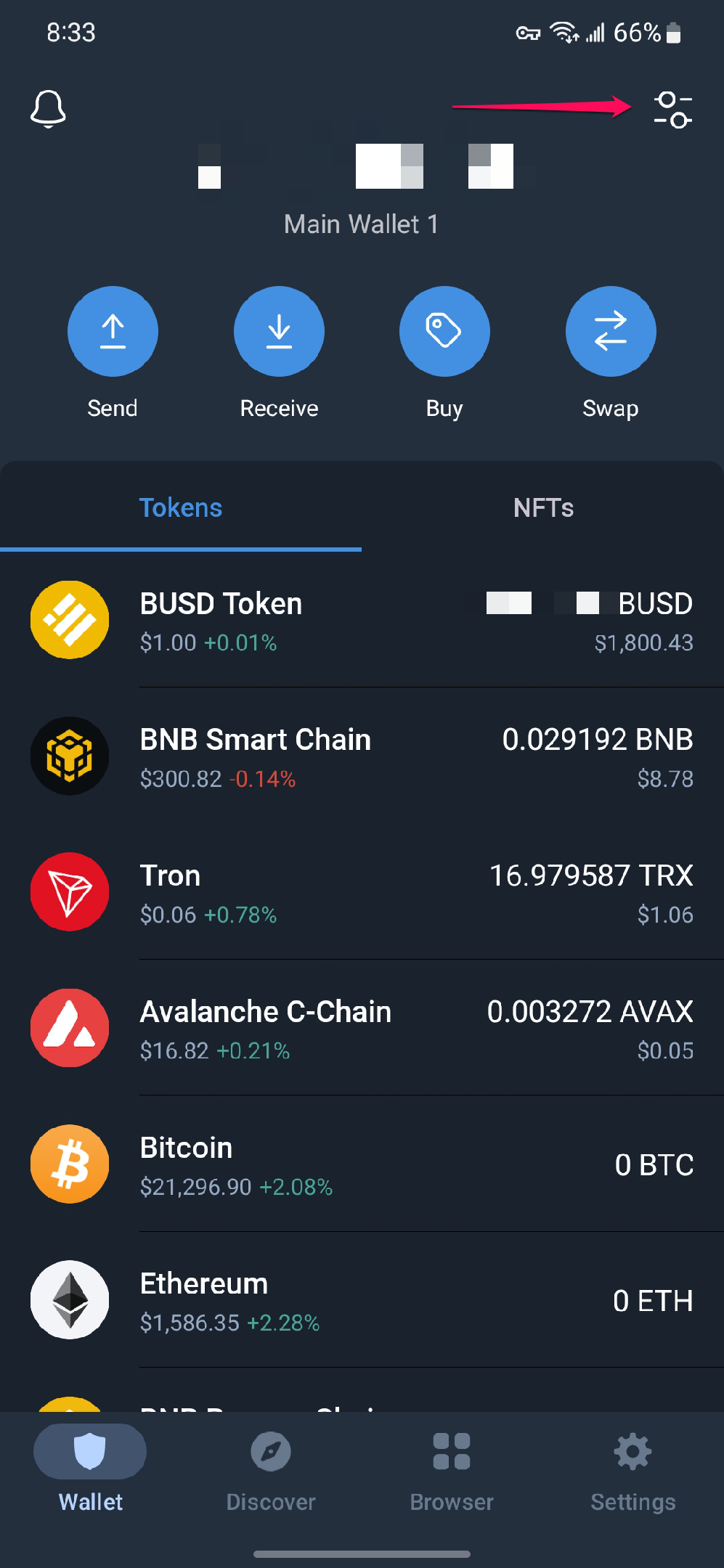

Step 1: Open the Trust Wallet app and click on the Token Management button. The button is located on the upper right corner of the Trust Wallet app.

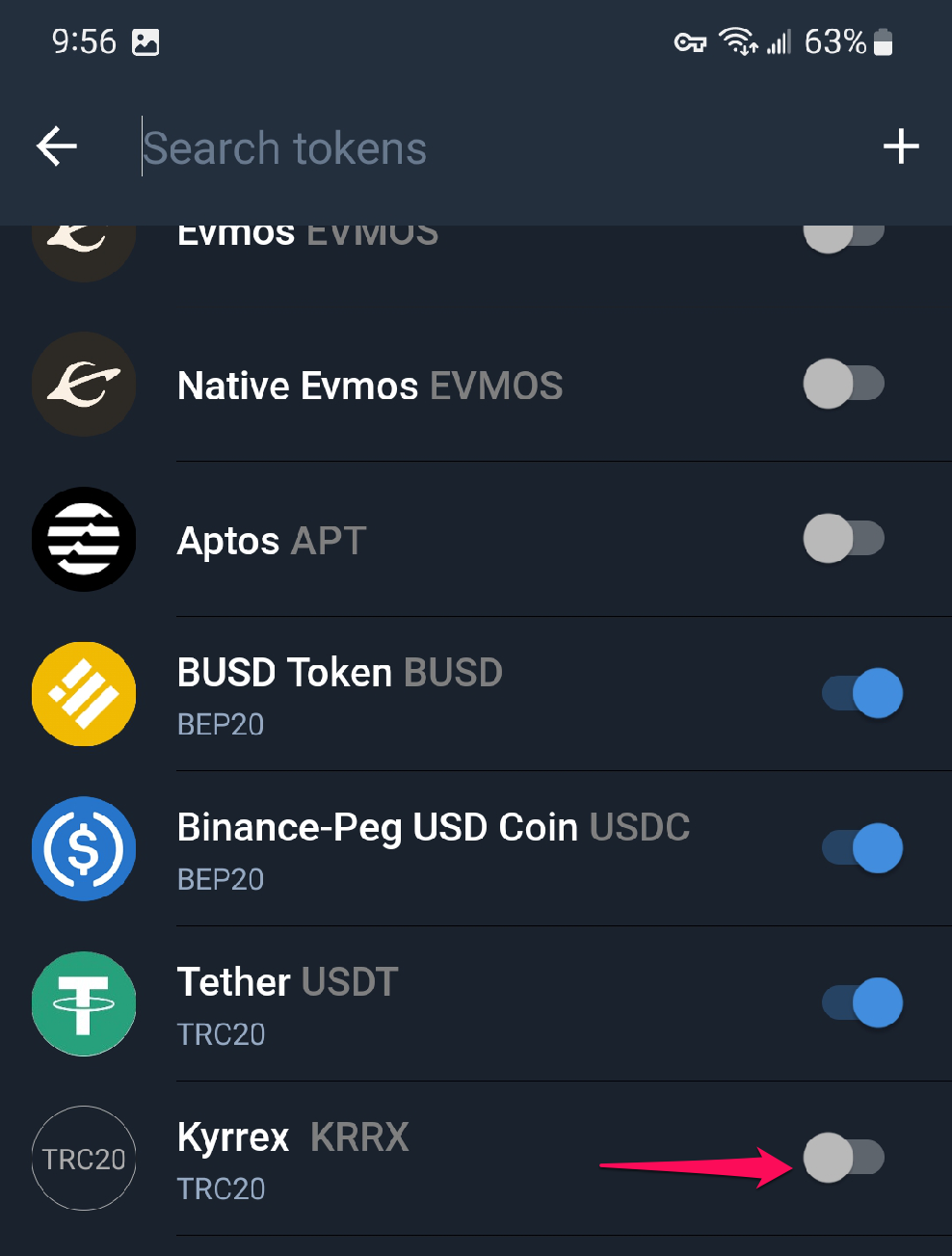

Step 2: Scroll down to Kyrrex in the list of tokens.

Step 3: Toggle the Kyrrex button to Off to remove the token from your Trust Wallet home screen.

Part 3: Add the New KRRX Token to Trust Wallet

IMPORTANT❗

Please update your Trust Wallet app to the latest version before you continue.

Step 1: Open the Trust Wallet app and click on the Token Management button. The button is located on the upper right corner of the Trust Wallet app.

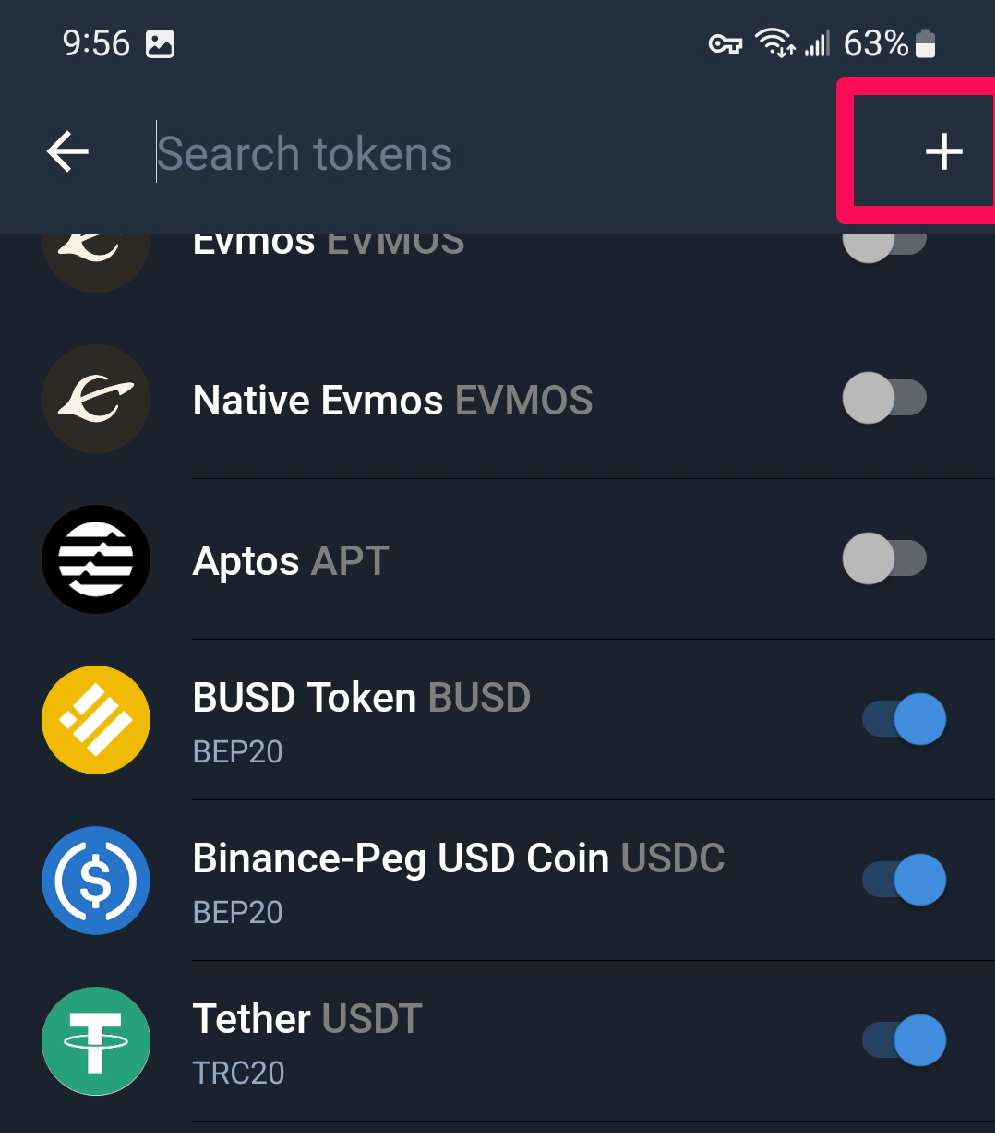

Step 2: Click the big ➕ icon at the top right corner of the Token Managementscreen. This will open the Trust Wallet Custom screen.

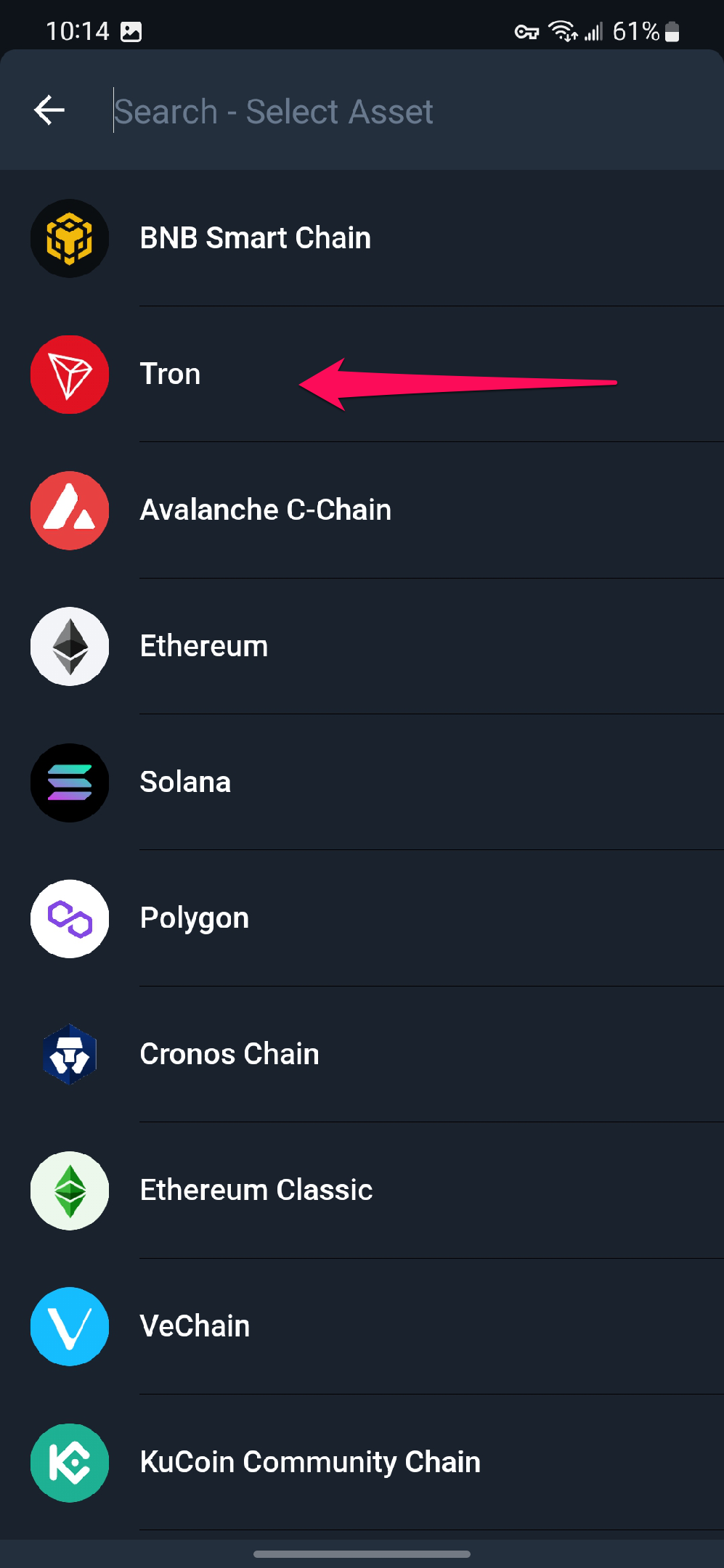

Step 3: Next step is to select the network. KRRX is a TRC20 token on Tron. So, click Network and select Tron.

Step 4: Select TRC20 and then paste the new KRRX contract address into the Contract Address field. The rest of the data will be filled automatically.

NEW KRRX CONTRACT ADDRESS:

- THS2ZuQowumzFPD1z3wchB1PijWMggUgmA

About Kyrrex

Kyrrex is a multifunctional professional platform for trading and storing cryptocurrencies

Tags

Categories

Related articles

Investing in Crypto: The Spanish Approach to Criptomonedas

Criptomonedas have become super popular with Spanish investors lately, and it's not at all surprising. Spain is actually a very big crypto market, at least if we're talking about Europe. To make things even more exciting, there are loads of ways Spanish crypto enthusiasts can get in on the hot action. In this article, we will show you the various methods available if you're trying to invest in crypto in Spain.

Investing Crypto in Spain: Your Options

Whether you want to directly buy coins or would rather do so through an intermediary, the Spanish crypto market has everything you need. Let's take a look at the most common ways to get involved:

1. Direct Ownership of Criptomonedas

The most obvious way is to simply buy and hold your own criptomonedas like Bitcoin, Ethereum, or other altcoins. You can grab coins on Spanish exchanges or big international ones, then stash them in software or hardware wallets. Spain has plenty of exchanges you can use. Older and more established exchanges like Coinbase are cool; you can also try out the up-and-comers like Kyrrex.

2. Cryptocurrency CFDs

Contracts for Difference (CFDs) let you bet on whether a cryptocurrency's price will go up or down, without actually buying the coins themselves. Think of it like betting on a sports team without being the owner. Brokers like eToro and Plus500 have crypto CFDs.

3. Cryptocurrency ETFs

Exchange-traded funds (ETFs) give you a piece of cryptocurrency action through regular stock markets. These ETFs follow the prices of major cryptos, basically doing the investing for you. Spain's main stock exchange, the BME, has a few crypto ETFs listed.

4. Crypto Index Funds

Think about when you picked up a basket containing different kinds of fruit on your visit to a friend. That's what crypto index funds look like. It's one big basket that contains several different kinds of cryptocurrency. An example in Spain is the A&G Index Fund, which has 70% exposure to various cryptocurrencies including bitcoin and ether. This type of crypto investment option helps to reduce risk by spreading exposure over multiple coins.

5. Hedge Funds

If you want someone with a lot of crypto experience to do the work for you, crypto hedge funds and venture capital funds offer that. These guys pool money from a bunch of investors and a professional manager actively picks a mix of crypto for everyone.

6. Cryptocurrency Interest Accounts and Lending

Think of these like a savings account for your crypto. Places like Nexo, Celsius Network, and CoinLoan let you deposit your crypto and earn interest. You can also use your crypto deposits as collateral to borrow either traditional money or other crypto.

7. Decentralized Finance (DeFi)

DeFi platforms bring crypto's message of autonomy closer to your doorstep. You can do things like lending, borrowing, and earning rewards that your local banks also offer without breaking a sweat. It's an automated avenue to investing criptomonedas and gives you more control over your money.

8. Crypto IRAs and Annuity Products

If you are investing crypto for retirement purposes, some investment companies are starting to offer these. They give you tax benefits while investing in the future of crypto.

9. Crypto Derivatives

Just like in traditional finance, you can use crypto to enter the derivatives game. Crypto futures and options offer you a chance to gain big by predicting market moves accurately. But you need to know what you're doing otherwise you might be in a big spot of bother when your moves go awry.

10. Non-Fungible Tokens (NFTs)

NFTs are cool as digital special art, collectibles, in-game items and so on. They're even cooler when you make a profit on them. They're a speculative bet on the future of digital ownership and how we'll interact with online spaces. Most experts recommend that NFTs shouldn’t be your priority when crypto trading Spain, but they can serve as a profitable diversion.

11. Cryptocurrency Mining

Mining is how new coins are created, but it's a really complicated thing to do. Basically, miners use powerful computers to solve complex puzzles that confirm crypto transactions. In return, miners get coins as a reward, but it takes a lot of energy. You should steer clear of this on your crypto trading Spain journey unless you’re loaded to the hilt and have plenty of cash to invest.

Major Cryptocurrency Companies in Spain

Spain is becoming a little hotbed for companies focusing on crypto. Here's a breakdown of the big areas they cover:

- Exchanges: Where you can buy and sell crypto – Bit2Me, Coinmotion, Coinbase, Criptan, Kyrrex and Bitpanda are a few.

- Wallets: Digital storage for your crypto - Coinmotion, Coinbase, Bit2Me, and Bitpanda have them.

- Payment Processors: Make it easy for businesses to accept crypto payments – like Coinmotion, Criptan, and Bit2Me.

- DeFi Platforms: Lending, borrowing, and other stuff with your crypto, all without a middleman – check out Beefy Finance and ParaSwap.

- NFT Marketplaces: Where you can buy and sell those unique digital items – try Marble.Cards, AllStarNFT, and World of V.

- Crypto Advisors: Companies that offer advice and research on all things crypto - 2gether, Collinstar, and Cartesi do this.

And there are even more—crypto mining hardware companies, blockchain development companies... The list keeps growing.

Major Banks Getting into Crypto

Even those old-fashioned banks are realizing people want crypto! Here's what some of the big ones are doing:

- BBVA: Lets you trade and store Bitcoin, Ethereum, and others right in their app.

- CaixaBank: You can buy Bitcoin and Ethereum through their investment platform.

- Santander: They have a crypto trading platform, but it's mostly for wealthy private clients.

Many banks offer some sort of crypto investment option these days.

The Tax Situation on Crypto

Spain treats crypto like any other asset you might buy and sell. So, if you make money trading crypto, you'll pay capital gains tax. Mining income is taxed like normal income.

Overall, Spain's tax rules make it a decent place to invest in crypto – some countries make it way harder on you.

Key Risks of Investing Criptomonedas in Spain

Investing crypto brings a mix of fear and hope, gains and losses. The potential is enormous and the risk is also vast. So, no matter when or where you invest your money in Spain, be prepared for the risks:

- Crazy Price Swings: Crypto values can jump up and down like a rollercoaster, It's more about speculation than steady investments.

- Regulation Issues: Regulation in many countries is far behind the advances made by crypto. As governments come to terms with the industry, it's wise to factor what they might do into your investment decisions.

- Security Woes: You must contend with having to trust your crypto with third parties—if they're on an exchange. You will also lose your crypto forever if you store them in a non-custodial wallet and forget your private keys or seed phrase.

- Bad Reputation: Crypto is used by criminals, which doesn't help its image.

- Whales Dominate: A few big players hold a ton of some coins, meaning they have a lot of control over prices.

- Hype and Panic: A lot of crypto projects rely on positive hype on their initial journey up the value chain. Unfortunately, negative hype (aka panic) can unravel all the momentum so be careful in the choice of projects you invest in.

Bottom line, you have to be able to handle risk and potential losses to invest in crypto. Safer options, like index funds, exist if that's not your thing.

Is cryptocurrency legal in Spain?

Crypto exchanges have the legal stamp of approval in Spain. Unlike other countries that treat crypto like a virus, the Spanish government embraces crypto and liberally dispenses licenses to crypto platforms that meet the regulatory criteria.

Future Outlook for Cryptocurrency Investing in Spain

With the unending influx of crypto exchanges and crypto products in Spain, the Iberian country is primed to become a choice location for digital currencies.

Meanwhile, crypto as a whole is still a new trend and hasn't quite cracked the mainstream yet. The best approach when investing criptomonedas in Spain is to treat it like an avenue for gradual financial growth. Be prudent, spread your portfolio around and be prepared to divest immediately when alarm bells strike. For investors willing to take the ride, Spain has plenty of ways to get into this exciting (and sometimes crazy) world.

Major Cryptocurrency and Blockchain Events in Spain

Spain with its great beaches and temperate climate is a fine place to live. It's also clearly a great place to host crypto meetups, going by the frequency and quality of blockchain events it hosts annually. Let's run through some of the most popular crypto-based hosted by Spain in recent years:

- Barcelona Trading Conference (BTC): A prominent European conference focused on crypto trading and blockchain technology, held annually since 2013.

- Blockchain Summit: This annual Madrid-based event explores blockchain innovation, investment trends, and regulatory developments.

- Smart City Expo World Congress: Held in Barcelona, this global summit examines the applications of blockchain within urban infrastructure and services.

- IoT Solutions World Congress: Barcelona hosts this leading conference on the Internet of Things, featuring discussions on blockchain-powered IoT ecosystems.

- Blockchain Business Forum: Madrid's premier blockchain event covers disruption and cross-industry transformation.

- Barcelona Technology Convention: This showcase highlights technological advancements, including blockchain, AI, and quantum computing, and their impacts on business and society.

- South Summit: A major startup event in Madrid with a strong history of crypto and blockchain content.

- Barcelona New Economy Week: An initiative aimed at positioning Barcelona as an international blockchain hub, featuring numerous public outreach events.

These conferences provide Spanish crypto investors valuable opportunities to connect with industry leaders, stay informed about emerging trends, highlight domestic innovation, and promote broader mainstream adoption.

Major Cryptocurrency Venture Investors in Spain

Several prominent venture capital firms are actively investing in Spanish blockchain and cryptocurrency startups:

- Seaya Ventures: Has supported crypto companies like Bitcoin remittance firm Bit2Me and crypto wealth management platform Indexa.

- Nauta Capital: Investor in digital identity startup Validated ID and blockchain software provider Onyze.

- K Fund: Backed Bitcoin ATM operator Criptan and crypto tax startup Libra Tax.

- Big Sur Ventures: Invested in the NFT platform MarbleCards and crypto education app Belearner.

- Finanbest: Funded Bitcoin payments processor Coinmotion.

- Active Venture Partners: Backer of the decentralized finance protocol ParaSwap.

- Keiretsu Forum: Invested in crypto real estate startup Homes4Coins and crypto gaming ecosystem World of V.

By attracting local and international venture capital, Spanish crypto startups gain resources to compete on a global scale while contributing to the domestic economy. This further strengthens the overall crypto ecosystem within Spain.

Conclusion

Spain offers a variety of regulated channels for cryptocurrency investment, ranging from direct coin ownership to DeFi protocols. Supportive legislation fosters greater legal certainty for investors. Those with a higher risk tolerance can take advantage of Spain's dynamic blend of progressive regulation and grassroots innovation. However, caution is always advisable given the inherent volatility of cryptocurrencies. Overall, Spain presents a positive environment for responsible and informed crypto engagement.

Crypto Trading Pairs Made Easy: Understanding BTC/USD vs. BTC/USDT

If you're new to cryptocurrency, you might be scratching your head over terms like BTC/USD and BTC/USDT. Don't worry; they're simpler than they seem! Think of them as little price tags for Bitcoin. Let's break down what they mean and why they're important.

What's the Deal with Trading Pairs?

Trading pairs are like the language of cryptocurrency markets. They tell you how much of one thing you can get for another. It's the same idea as exchanging Euros for US dollars – you've got a pair! BTC/USD and BTC/USDT simply show the exchange rate between Bitcoin and another asset.

BTCUSD: The Classic Bitcoin Price Tag

BTC/USD is the most basic way to see how much Bitcoin is worth in US dollars. If BTC/USD is at $20,000, it means you'll need 20 grand to buy one Bitcoin. This pairing is like your classic price tag, making it easy to compare Bitcoin's value against the most common currency in the world. Just remember, like any currency, the price of Bitcoin goes up and down based on how much people want to buy or sell it.

BTCUSDT: Meet the Stablecoin

BTCUSDT tells you the value of Bitcoin in Tether (USDT). So, what's Tether? Well, it's what we call a "stablecoin." Stablecoins are special cryptocurrencies designed to hold a steady value – think of them as the less-jumpy cousins of regular crypto. One USDT is supposed to always be worth one US dollar.

So, if the price of BTC/USDT is $20,000, it still means one Bitcoin equals $20,000. The difference is that you're looking at the price through the lens of a stablecoin.

Why Bother with Stablecoins?

Here's where stablecoins get cool:

- Taking a Break from the Rollercoaster: Crypto prices can be super bouncy. Stablecoins are like safe havens. If things get too wild, traders can swap their Bitcoin for USDT to keep the same dollar value without cashing out completely.

- Trading Made Smoother: Stablecoins make it easier and faster to switch between different cryptocurrencies. Think of USDT like the universal translator of the crypto world.

BTC USD vs. BTC USDT: The Lowdown

Okay, now you get the tickers, but how are they really different? Here's the simple version:

- BTC/USD is the rollercoaster. It shows Bitcoin's price against the US dollar, which changes all the time thanks to the crazy world of finance. BTC/USDT is pegged to the dollar, so it's less bumpy.

- BTC/USD is for ups and downs. It pairs two things that change in value constantly. BTC USDT is more chill (usually) because Tether is designed to stick to $1.

- BTCUSDT is for crypto adventurers. It makes switching between different cryptocurrencies a breeze, no need to mess with regular dollars. BTC/USD is better for folks who just want to trade Bitcoin the old-fashioned way.

- BTC/USD is dollars and cents. Simple and clear. BTC USDT is more like a roundabout way of showing the same thing.

- BTC USDT is where the action is. Because of the stablecoin magic, you'll usually find more people trading with BTC/USDT on the big exchanges.

- BTC/USD is for classic investors. If you care about the dollar value and want to day trade, stick with this.

Both are super important ways to trade Bitcoin. Which one is right for you depends on whether you like a smooth ride or the thrill of the market!

BTCUSDT vs. BTCUSD: Usually the Same, Sometimes Not

If you check out the price charts, you'll see that BTC/USD and BTC/USDT prices usually move in sync. Makes sense, since Tether is meant to mirror the US dollar. But here's the thing – things can get a little weird sometimes.

When the crypto market goes totally nuts, Tether can sometimes get knocked off its $1 peg. It might dip below a dollar or even spike above it. That's when you get a difference between the two charts… and a chance for quick-thinking traders to make a profit fixing things.

But don't worry, over the long run, the charts for BTC/USD and BTC/USDT tend to stay pretty close. After all, they're both tracking Bitcoin's value against the dollar, just in slightly different ways.

BTC/USDT: The Crypto Crowd Favorite

We mentioned that BTC/USDT usually sees way more trading action than BTC/USD. Well, the numbers really back this up. A recent study showed that BTC/USDT trading volume was more than 7 times higher than BTC/USD over the past year. Plus, way more exchanges offer BTC/USDT trading.

This tells us that crypto traders definitely lean towards using Tether. It's also interesting that BTC/USDT trading is spread out across exchanges, while BTC/USD is clumped up on a few big ones like Coinbase. This likely means it's easier for exchanges to set up Tether trading, while dealing with actual dollars has more hoops to jump through.

The Takeaway

Okay, so BTC/USD and BTC/USDT both track Bitcoin's value against the dollar, but they do it differently:

- BTC/USD: The raw deal. It shows you Bitcoin's price against the dollar, no tricks. This price goes up and down based on how much people want Bitcoin at that moment.

- BTC/USDT: The smoother option. It shows you Bitcoin's worth in Tether, which is meant to stay around $1. This can help shield you from the crypto market's crazy price swings.

Why it matters:

- BTC/USD: Straight-up reality check. This is the best way to see Bitcoin's actual value in the 'real world'.

- BTC/USDT: The crypto trader's tool. If you're always swapping between cryptocurrencies, Tether makes things easier since you don't have to mess with regular dollars as much.

Both BTC/USD and BTC/USDT are important tools for understanding Bitcoin's price and trading in the crypto world. Whether you're into long-term holding or fast-paced crypto action, knowing how these pairs work will help you navigate the market with confidence.

The Story of DOGE: How a Meme Became a Leading Cryptocurrency

Dogecoin (DOGE) is one of the most well-known and widely-used cryptocurrencies today. But unlike Bitcoin and Ethereum, which were created with serious intentions, Dogecoin has much humbler origins—as an internet meme that took on a life of its own. This is the story of how a joke became a multi-billion-dollar cryptocurrency.

The Birth of DOGE

In 2013, software engineers Billy Markus and Jackson Palmer launched Dogecoin as a satirical take on the sudden hype surrounding cryptocurrencies. They branded the coin's logo using a popular internet meme at the time featuring a Shiba Inu dog accompanied by broken English phrases like "wow" and "such coin."

Markus has said Dogecoin was created "to poke fun at the wild speculation going on in cryptocurrencies." The lighthearted approach was meant to encourage more casual participation since Bitcoin was perceived as too serious and inaccessible to the average person.

Going Viral: DOGE Takes Off

Though created as a parody, Dogecoin quickly took off and developed an online community. The low Dogecoin price and unlimited force made it popular on social media.

In December 2013, the Dogecoin community raised $30,000 worth of DOGE coins to send the Jamaican bobsled platoon to the Sochi Winter Olympics when they couldn't go. This and other high-profile charity fundraising campaigns associated with Dogecoin generated media attention and goodwill.

By early 2014, Dogecoin's market cap had reached over $60 million. Its community on Reddit boasted over 85,000 subscribers. DOGE established itself as a prominent altcoin and proved that a cryptocurrency didn't need to be serious or technically groundbreaking to gain significant attention.

The Power of Memes: DOGE in Pop Culture

A major factor in Dogecoin's continued fashionability has been its use in internet memes and viral content. The meme-friendly coin represents a confluence between cryptocurrency and internet culture.

On Reddit, Twitter, and other social platforms, Shiba Inu memes featuring expressions like "1 DOGE = 1 DOGE" and" To the moon!" have kept Dogecoin circulating in online exchanges. This grassroots marketing, amplified by memes, has propelled DOGE's brand recognition.

Celebrity signatures have also given Dogecoin periodic boosts. In 2020, Elon Musk posted memes about DOGE on Twitter, leading to a sharp Dogecoin price increase. Mark Cuban and Snoop Dogg have also shown support for the meme coin. DOGE thrives on its pop culture applicability.

Serious Growth in 2021

In early 2021, Dogecoin endured a gradual rise fueled by growing interest on social media and from institutional investors. In January, the r/WallStreetBets subreddit that boosted GameStop stock began encouraging investments in Dogecoin. Dallas Lions proprietor Mark Cuban even blazoned that his organization would accept DOGE for wares and ticket deals.

In May 2021, DOGE hit an all-time high of $0.7376 shortly after Elon Musk appeared on Saturday Night Live and called Dogecoin the" future of currency." The coin's market cap reached over $80 billion. This period demonstrated that Dogecoin had progressed far beyond its meme-rooted origins. Major companies and investors were now treating DOGE as a legit digital asset.

The DOGE Community

A crucial part of Dogecoin's identity and success has been its vibrant online community. On Reddit, Twitter, and Discord groups, Dogecoin backers organize fundraising drives, create memes, and spread enthusiasm for the coin.

Unlike some cryptocurrency groups, which are exclusive and specialized, the Dogecoin community prides itself on being accessible to beginners. It embraces DOGE's roots as an approachable, unconcerned coin for the internet legions rather than solely a serious investment vehicle. This grassroots energy and fidelity have helped drive the Dogecoin euro price surge and given it a distinctive appeal.

Criticisms of the Dogecoin Price Model

Some critics argue that Dogecoin's lack of genuine invention or usefulness makes it a bad cryptocurrency compared to blockchain innovations like Ethereum. Its unlimited supply and the low Dogecoin euro price also mean the cryptocurrency is super volatile and easily manipulated.

Others contend that Dogecoin derives its value purely from jokes and marketing hype rather than mileage. They see the coin as a pump-and-dump scheme centered around online hype rather than fundamentals.

Proponents argue that the Dogecoin blockchain is still growing and already faster compared to Bitcoin. They point to DOGE's growing number of fans, users and developers as proof that is has segued into something meaningful beyond just internet hype.

DOGE Milestones

Despite the naysaying in certain quarters, Dogecoin has achieved several milestones that demonstrate its progression into a mature cryptocurrency.

- In 2014, Dogecoin innovated the use of merged mining with Litecoin, allowing miners of both coins to partake in calculating power for increased effectiveness. This was an early, specialized use case for DOGE.

- Major brands like Slim Jim have run marketing campaigns centered around Dogecoin and memes. This indicates commercial interest in tapping into the DOGE phenomenon.

- The nonprofit Dogecoin Foundation was revived in 2021 after a period of dormancy. The renewed interest in supporting the coin's open-source development reflects its growing mainstream appeal.

- DOGE is now supported by most major cryptocurrency exchanges and trading and payment apps like Robinhood and Coinbase. Availability for investors and consumers has improved significantly.

The Future of DOGE

As crypto tokens go, Dogecoin is one of the major and most recognizable. People have grown to rely upon it as a cultural touchstone for cryptocurrency humour and Old Internet jokes alike. That being said, what exactly does the future hold for DOGE; after it has shaken off its meme-derived roots and become a more mature technology?

Some see Dogecoin as a means of payment that is faster and cheaper than ever before. Others feel it is essential for DOGE to make inroads into decentralized finance (DeFi) solutions and the NFT space.

Still, for Dogecoin to advance to the next level, critics say it needs to continue developing its burgeoning technology for real-world usage. More serious investment in development and mainstream partnerships is needed for DOGE to thrive in the long term.

But if its history has shown anything, it's that coins like Dogecoin shouldn't be underestimated. DOGE has once already defied disbelievers and cemented its place in cryptocurrency lore. The vibrant community of Dogecoin is its X factor, something that many coins hardly have.

As a joke coin, Dogecoin has already realized remarkable successes. One hopes for its future, but this meme coin-cum-bitcoin continues to show that internet culture must not be overlooked when evaluating the future potentials of crypto.

The Technology Behind DOGE

While created as a meme coin, Dogecoin operates on a real blockchain and cryptocurrency network. Understanding the technical rudiments provides insight into its functionality.

The Blockchain

The Dogecoin blockchain is predicated on Luckycoin, which itself derives from Litecoin. It uses a decentralized proof-of-work system where miners compete to solve mathematical problems and produce new blocks. This secures the network and provides the foundation for DOGE as a cryptocurrency.

Mining Dogecoin

Dogecoin mining uses the Scrypt algorithm, which is less complex than Bitcoin's SHA-256. Scrypt mining can be performed with even basic PCs rather than the precious ASIC equipment demanded for Bitcoin mining. This makes the Dogecoin network more accessible.

Transaction Speed

Dogecoin's 1 minute block time makes DOGE 10 times faster compared to Bitcoin's 10-minute finality time. This speed enhances Dogecoin's suitability for point-of-trade purchases, micropayments, and other transactional uses.

Unlimited Supply

A crucial difference from Bitcoin is Dogecoin's emission rate. 10,000 DOGE are mined per block, with no limit on the total number created. This provides an inflationary counterpoise to Bitcoin's fixed supply. If there is anything that can pause or even reverse the long-term Dogecoin price momentum, it is this inflationary aspect of its tokenomics.

Keeping Dogecoin Relevant

DOGE might have been the best success story of the crypto memecoin craze, successfully fending off fierce competition from Shiba Inu and the array of new challengers from the Solana space. However, nothing lasts forever—success will eventually dissipate if not sustained and Dogecoin is no exception. Over the years, the community has rolled out a few things to make sure that the cryptocurrency retains its spot in the limelight.

Current Developments

The original core developers of DOGE have long sailed into the sunset. However, a new group of dedicated developers have taken up the mantle and continue to maintain the Dogecoin codebase. There are even plans underway to upgrade the network with special features and advancements that will keep it relevant in the digital currency space.

Major DOGE Events

Dogecoin has long moved past sole reliance on viral moments and meme to gain traction. Now an established behemoth in its own right, the network continues to make its mark through major events and fundraisers. Here are some noteworthy instances:

- 2014 Winter Olympics: The Dogecoin community raised $30,000 worth of DOGE coins so the Jamaican bobsled platoon could attend the Sochi games. This put DOGE in the media spotlight for the first time.

- Doge4Water: In 2014, the Dogecoin community bestowed over $50,000 worth of DOGE to fund the creation of clean water wells in Kenya. This remarkable feat was one of the very first demonstrations of crypto’s transformative impact on charity.

- Doge4NASCAR: The community sponsored NASCAR motorist Josh Wise to the tune of over $55,000 in DOGE coins. The DOGE logo on his car and jumpsuit brought Dogecoin's name into mainstream sports.

- DOGE-1 Satellite: In 2021, Dogecoin funded the DOGE-1 satellite set to launch through SpaceX. It'll be the first crypto-funded project in space and collect lunar data.

These caption-grabbing moments have shaped Dogecoin's story and shown that it's more than just an internet meme.

How to Buy DOGE and Check Dogecoin Price

For those interested in this notorious memecoin, it's easy to buy Dogecoin. There are many options.

- Exchanges: Major crypto exchanges like Kyrrex, allow direct DOGE purchases with fiat or crypto. This is the most straightforward buying method.

- Trading Apps: Apps like Robinhood and Webull offer quick signup and the capability to buy Dogecoin without actually holding the coin itself.

- Wallets: Software and hardware wallets like Trust Wallet or Ledger let users buy DOGE directly and store it securely. Some of them also allow spending DOGE at merchandisers accepting the coin.

- Mining: Users can mine DOGE by joining a Dogecoin mining pool and contributing calculating power. Still, single mining isn't very practical for average users.

- P2P Trading: Websites like LocalDogecoins connect buyers and sellers directly for DOGE trading without a central exchange. This allows for fast deals.

What Can You DO With Dogecoin?

While frequently treated as a joke or memecoin, Dogecoin can still be used for serious purposes.

- Paying for Goods and Services: A number of crypto businesses now accept DOGE as a payment method. The picture is less rosy outside the crypto space but you can still find a few online markets that either already accept the token or may do so in the future.

- Tip Jar for Content Generators: DOGE is one of the favorite tipping methods online. Bitcoin and ETH used to be more popular tipping methods. But now that they are both super pricey, coins like DOGE have stepped into the gap.

- Trading and Investment: Punters and investors trade DOGE with the end goal of profiting from the Dogecoin price volatility.

- Money Transfer: DOGE offers a fast way to transfer value digitally due to its speed and low costs.

- Donations/Fundraising: As demonstrated by its early moves in the charity space, Dogecoin can be—and indeed has been—used for both single large donations and community fundraising.

Conclusion

Dogecoin is an intriguing intersection between cryptographic technology and internet culture. Born of a meme joke, it has become a major cryptocurrency with billions of dollars in real-world value and a devoted community.

Nevertheless, questions about the likelihood of DOGE becoming a blockchain with more advanced capabilities and real-world use cases continue to linger. Perhaps, it will remain as chiefly an entertainment tool and an avenue for daring speculators to realize their dreams.

Dogecoin is, at the very least, an educational case study. It is a testament to the power of online communities and how far enthusiasm and devotion can achieve. Whatever happens, the DOGE currency has already accomplished more than its creators ever anticipated.

© 2018 - 2024 All rights reserved