#TRADING PLATFORM

Navigating the Ethereum Valore Euro

Introduction

the ever-evolving realm of cryptocurrencies, Ethereum stands out as a key player, attracting investors with its technological prowess and potential for growth. This article explores the current and projected valore of Ethereum in euros, shedding light on market trends and offering valuable insights for those considering investing in criptomonedas, with a special focus on the precio Bitcoin euro.

Unraveling the Ethereum Valore Euro Dynamics

The valore Ethereum euro is a crucial metric for investors seeking a comprehensive understanding of Ethereum's performance in the European market. This real-time exchange rate encapsulates the ongoing value of Ethereum in euros, serving as a vital reference point for strategic decision-making.

Ethereum Valore Euro: A Snapshot of the Present

Ethereum has firmly established itself in the cryptocurrency market, with its value subject to fluctuations influenced by a variety of factors. For those keen on comprehending the Ethereum valore euro, staying abreast of market trends and technological developments is essential.

Factors Influencing Ethereum Valore Euro

- Market Demand and Supply: The economic principles of demand and supply play a pivotal role in determining the valore Ethereum euro. A surge in demand coupled with limited supply can propel Ethereum's value.

- Technological Advancements: Ethereum's value is intrinsically tied to its technological progress. Upgrades and innovations can positively influence its valore in euros.

- Investor Sentiment: Market sentiment holds significant sway over cryptocurrency valuations. Positive news, partnerships, and endorsements can elevate the Ethereum valore euro.

Ethereum Valore Euro Previsioni: Navigating the Future

Predicting the future value of Ethereum in euros involves a degree of speculation, given the dynamic nature of the cryptocurrency market. Ethereum valore euro previsioni can be shaped by factors such as:

- Adoption and Integration: Increased adoption and integration of Ethereum into various applications can positively influence its future value in euros, making it an enticing option for investing in criptomonedas.

- Regulatory Landscape: Regulatory developments significantly impact cryptocurrency markets. Clarity in regulations often contributes to a more favorable Ethereum valore euro, aligning with a secure investing environment.

- Market Analysis and Trends: Historical data and market trends play a crucial role in making informed predictions about Ethereum's future value in euros, particularly for investors navigating the realm of investing in criptomonedas.

Investing in Criptomonedas with Ethereum: A Strategic Approach

As investors contemplate the broader world of criptomonedas, Ethereum's unique features and potential for growth make it a compelling choice. Strategically combining an understanding of the Ethereum valore euro with insights into the precio Bitcoin euro can enhance investment decision-making.

Conclusion

In conclusion, the Ethereum valore euro encapsulates the dynamic nature of cryptocurrency markets. Whether you are a seasoned investor or a newcomer interested in investing in criptomonedas, staying informed about Ethereum's performance, market trends, and the precio Bitcoin euro will undoubtedly contribute to more informed and strategic decision-making in this exciting and ever-changing landscape.

Kyrrex EU: Your Gateway to Secure and Compliant Crypto Trading

Investing in cryptocurrency is smart given the benefits of profit and financial security. But these benefits can vanish like smoke along with your investment, unless you use a secure and compliant crypto trading platform like Kyrrex EU. Simple, secure, and transparent, Kyrrex EU helps people and institutions become innovative, thereby enabling them to get and do more with money.

Let’s examine some of Kyrrex’s attributes to see why and how it is different from the others. You will also find step-by-step guides on how to increase your chances to get high returns on your investments.

Buy Crypto, Invest in Innovation

Innovation is the guiding principle of Kyrrex. Its philosophy is that with enough help, anybody can become resourceful and enterprising, especially with crypto. Kyrrex’s trading platforms therefore provide the necessary stage for you to buy cryptocurrencies and related digital assets. As the prices of these assets increase, so would your investment portfolio, experience, and opportunities for profit.

For a beginner, Kyrrex’s user-friendly platform makes it easy to join the world of crypto innovators and investors. You can sign up and immediately buy whatever cryptocurrencies you need to with your debt or credit card. Every delay can reduce your chances at a strong and energetic crypto journey, so the debit/credit card option helps get you on track without losing time.

1. Compliance Is Foremost

Kyrrex’s excellence is built on its compliance with regional crypto regulations. To meet the European directives on crypto trading, Kyrrex has a Class 4 VFA License issued by the Malta Financial Services Authority (MFSA). This license indicates that Kyrrex is serious about complying with the regulations and will continue to protect clients’ investments and assets. So, you can trade cryptos with Kyrrex’s platforms, confidently assured that Kyrrex is reliable.

2. Supreme Security Measures

Kyrrex prioritizes the trust of its clients. It demonstrates this commitment by using advanced security protocols to protect your assets from hackers, digital bugs, and whatever else can frustrate your crypto trading journey. Kyrrex’s security measures are endorsed by Hacken and the company itself is ISO-certified. With Chainalysis AML technology in place, Kyrrex detects fraudulent activities from miles away and blocks them.

3. Effortless Purchase Methods

The benefits of crypto trading are many, but the methods to trade effectively are few. Kyrrex recognizes this inconsistency and offers easy ways to overcome it. For example, Kyrrex does not restrict you with regards to how to buy cryptos. Instead, you can use difference purchase methods. These include debit/credit cards, bank transfer, and crypto deposits, all convenient means to invest in cryptos.

4. Transparent and Low Commissions

To boost trading convenience, Kyrrex EU has measures in place to reduce trader fatigue and frustration. These measures cover Kyrrex’s commission system and transparency. The commission system lets you trade with as low as 0.25%, a reasonably affordable rate. There are no extra or ambiguous fees, meaning that you can keep as much as you earn during and after trading.

Crypto Trading Made Easy

Kyrrex favors clear and uncomplicated crypto trading. Its platforms reflect this trading mode with straightforward interfaces and useful features. Using Kyrrex’s mobile apps and web options also helps you better familiarize yourself with the various concepts of the trading environment, making it more accessible to you.

Buy Crypto Within Minutes

Corresponding to Kyrrex’s focus on simplicity, you can buy cryptos from the platform within minutes. To buy and trade cryptos like this:

- Create your free Kyrrex account.

- Choose your preferred payment method, whether it’s a debit/credit card or bank transfer.

- Get crypto into your account.

These simple steps get you started on your crypto journey and you can build a brilliant and rewarding crypto/digital asset base in no time.

Safely Store, Monitor, and Manage Your Crypto

Efficiently trading cryptos demands that you have a secure digital wallet to store your assets. Kyrrex gives you access to such a wallet along with your created account. In addition, it also offers you custody services which supplement asset storage and make it easy for you to monitor and manage your digital valuables.

With this arrangement, you can go from merely buying and selling cryptos to building a strong and engaging investment portfolio to get others to entrust you with their cryptos.

Regulatory Considerations

As a Class 4 Financial Assets Services provider, Kyrrex’s operations are supervised by the Malta Financial Services Authority (MFSA). This strict oversight approves all of Kyrrex’s operations and services, including:

- operating a VFA Exchange

- providing digital wallet/custody/nominee services

- offering VFA transfer services

An important disclaimer: some of Kyrrex’s products and services are only available in some parts of the world. Access to these products and services are determined by regional regulations on crypto trading companies. Therefore, only some of Kyrrex’s services are treated the same way with regard to regulation in Malta.

Create your personal crypto account for individuals

Overall, Kyrrex is a straightforward, secure, and reliable platform. You can use it to trade cryptos effectively, whether you are a beginner or an expert. Because it uses advanced security measures to protect your information and assets, you have nothing to fear from hackers. Also, its compliance with regional regulations on crypto trading means that your investment is safe and your digital assets are in good hands.

Kyrrex for Institutions

Kyrrex EU is just as useful for individual crypto traders as it is for institutions, covering official and private clients. It is designed to match and satisfy different trading needs and preferences.

This adaptation is possible because Kyrrex uses an advanced technological framework made up of multiple responsive algorithms. Run and supervised by competent experts, Kyrrex easily adjusts to its wide range of clients across various sectors.

Serving a Wide Range of Clients

Kyrrex serves clients ranging from brokers to online banks and other fintech companies. Also included in this array of Kyrrex’s clients are hedge funds, proprietary traders, family offices, and aggregators.

Kyrrex appeals to these institutions because it guarantees quick and unhindered access to all trading markets. The advantage of being a web-based platform is also fully maximized as Kyrrex helps its clients speed up business processes, safeguard digital assets, and enhance their credibility.

With Kyrrex’s array of services and features, institutions can engage clients and the market confidently, efficiently earning profits from credible business processes. This includes institutions that operate in the cryptocurrency landscape, as well as those that protect client funds.

Ultimately, Kyrrex EU partners with institutions to leverage available useful products and services, with effective processes. This way, beginners grow to become experts, and experts engage new markets, all benefiting from Kyrrex’s dynamic trading platform, expertise, and reach.

Create your business crypto account for institutions

Kyrrex Incorporates TradingView Charts

Effective crypto trading hinges on the precise interpretation of market movements and trends. This necessitates powerful analytical tools, especially functional charts that can depict the nuances of volatile market shifts.

At Kyrrex, our primary objective has always been to simplify and enhance the trading journey for our users. In pursuit of this goal, we are using TradingView charts in our platform. This integration empowers our users to consistently access hyper-accurate quotations, monitor asset price trajectories, and deploy over 15 customizable chart types coupled with 100+ analytical tools.

Spotlight on TradingView

TradingView started in 2011, thanks to the vision of Stan Bokov, Denis Globa, and Constantin Ivanov. Since then, it has grown into a major charting and networking platform for traders around the world. It's built for traders of all levels, offering tools and features that make trading more understandable.

Key Advantages of the TradingView Collaboration

Harnessing the strengths of both Kyrrex and TradingView, our collaboration delivers an enhanced trading experience characterized by the following features:

- Up-to-date and accurate quotations for informed trades;

- Over 15 chart types for diverse analysis preferences;

- 100+ analytical tools for comprehensive market research;

- High-speed performance ensuring quick data access;

- Intuitive interface customization to tailor user preferences;

- Responsive design for optimal display on mobile and desktop devices;

- Seamless integration for a smooth user experience.

By marrying our robust trading ecosystem with TradingView's analytical prowess, we ensure our users are not just trading but trading smarter.

You can experience the functionality and speed of TradingView charts in the trading section of your Kyrrex account on any device.

KYC Providers vs. In-House KYC: Pros and Cons for Crypto Exchanges

KYC procedures involve collecting and verifying personal information from customers to establish their identity and ensure that they are not engaging in illicit activities. Exchanges need to comply with regulatory requirements, which vary from country to country. To meet these obligations, they can either rely on third-party KYC providers or develop their own in-house KYC systems. Both options have their own set of advantages and disadvantages, which we will explore in the following sections.

KYC Providers: Advantages and Disadvantages

Using third-party KYC providers is a popular choice for many crypto exchanges. These providers specialize in verifying customer identities and complying with regulatory guidelines. Here are some advantages and disadvantages of using KYC providers:

Advantages:

- Expertise and Experience: KYC providers have dedicated teams with expertise in identity verification and compliance. They keep up with the latest regulations and industry best practices, ensuring that the exchange remains compliant.

- Efficiency: KYC providers have established processes in place, allowing for swift verification and onboarding of customers. This saves time and resources for the exchange.

- Cost-Effective: Outsourcing KYC procedures to a third-party provider can be cost-effective for smaller exchanges that lack the resources to develop their own in-house system.

Disadvantages:

- Limited Control: When relying on a third-party KYC provider, the exchange has limited control over the verification process. Any issues or delays may impact the customer experience and the exchange’s reputation.

- Dependency: Exchanges relying on KYC providers are dependent on their services. If the provider faces technical issues or goes out of business, it can disrupt the exchange’s operations.

In-House KYC: Advantages and Disadvantages

Developing an in-house KYC system gives exchanges full control over the verification process. They can tailor it to their specific needs and ensure compliance. However, there are also some drawbacks to consider:

Advantages:

- Customization: Creating an in-house KYC system allows exchanges to customize the verification process according to their specific requirements. This flexibility ensures that the system aligns perfectly with the exchange’s policies.

- Control: With an in-house KYC system, exchanges have complete control over the verification process. They can implement additional security measures and adapt the process as regulations change.

- Brand Confidence: By handling the KYC process internally, exchanges can build customer trust and confidence in their brand. Customers may perceive in-house systems as more secure and reliable.

Disadvantages:

- Resource-Intensive: Developing and maintaining an in-house KYC system requires significant resources, including technical expertise, personnel, and ongoing maintenance.

- Compliance Risks: Building an in-house KYC system means that the exchange assumes full responsibility for compliance. This can be challenging, considering the ever-changing regulatory environment.

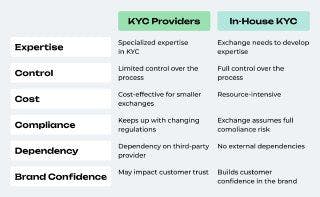

Comparison of KYC Providers and In-House KYC

To have a clear understanding of the pros and cons, let’s compare KYC providers and in-house KYC in a table-format:

Factors that Influence Choice of KYC System

The choice between KYC providers and in-house KYC depends on factors such as the exchange’s size, budget, regulatory environment, and long-term goals. Exchanges need to carefully assess their specific needs and weigh the pros and cons before making a decision. Let's consider these in more detail:

Exchange Size

The size of a crypto exchange plays a significant role in determining the choice between using KYC providers or an in-house KYC solution. Larger exchanges, handling a high volume of users and transactions, might find it more efficient to partner with established KYC providers. These providers offer scalable solutions and expertise in managing a large number of verifications swiftly. Smaller exchanges, on the other hand, could consider an in-house KYC approach if their user base is manageable, as it provides more control and customization over the process.

Budget

The financial resources available to an exchange are a crucial factor in this decision. Partnering with external KYC providers often involves costs, including licensing fees and per-verification charges. On the other hand, setting up an in-house KYC system requires initial investment in technology, personnel, and ongoing maintenance. Exchanges must balance the cost of outsourcing with the potential benefits of maintaining direct control over their KYC process.

Regulatory Environment

Compliance with regulatory standards is paramount in the cryptocurrency space. The regulatory environment of the exchange's operating jurisdiction greatly influences the choice between KYC providers and in-house solutions. Some jurisdictions might have strict requirements that necessitate close collaboration with specialized providers to ensure compliance. In contrast, more lenient regulations might allow exchanges to implement their own processes in-house.

Long-Term Goals

A crypto exchange's long-term goals shape its strategic decisions, including how it handles KYC. Exchanges aspiring for rapid growth might opt for KYC providers due to their scalability and speed. On the other hand, exchanges aiming for unique customer experiences or a specific branding might lean towards in-house KYC, as it offers greater customization and control. Long-term plans could also factor in the potential to integrate KYC data with other services or applications, influencing the choice between external providers and internal solutions.

Geographic Reach

If an exchange serves a diverse international user base, it might need to work with KYC providers that can cater to different regions' compliance requirements and language preferences.

User Experience

The ease and convenience of the KYC process for users can significantly impact their perception of the exchange. Depending on the target audience and user preferences, exchanges might opt for a solution that offers a smoother and more user-friendly onboarding experience.

Speed of Implementation

Time-to-market can be crucial, especially in a competitive industry like cryptocurrencies. Exchanges might choose a solution that can be quickly integrated and deployed to meet immediate compliance requirements.

Scalability

If an exchange anticipates rapid growth or fluctuating user volumes, scalability becomes a vital consideration. KYC providers often offer the advantage of handling large-scale verifications efficiently.

Operational Expertise

Some exchanges might lack the necessary expertise to set up and manage an in-house KYC system effectively. In such cases, partnering with a specialized provider could be a more viable option.

Conclusion

KYC procedures are essential for ensuring the security and compliance of cryptocurrency exchanges. The choice between KYC providers and in-house KYC systems requires consideration of various factors. KYC providers offer expertise, efficiency, and cost-effectiveness, but come with limited control and dependency. On the other hand, in-house KYC offers customization, control, and brand confidence, but requires significant resources and assumes full compliance risk.

Each approach has its own set of advantages and disadvantages, and exchanges must carefully evaluate their needs and goals before deciding on the best approach to implement KYC procedures. By making an informed decision, exchanges can enhance their security measures and build customer trust.