WHITE LABEL

MiCA crypto regulation: How MiCA Framework Revolutionizes Crypto Asset Management in the EU

The European Union has taken a pioneering step with the introduction of the MiCA (Markets in Crypto-Assets) framework or MiCA crypto regulation. This groundbreaking regulation represents a significant shift in the landscape of crypto asset management within the EU, marking a transition from a largely unregulated space to one guided by clear rules and standards. At the heart of this change is the need to establish a harmonized and secure environment for both investors and crypto service providers, ensuring that the dynamic world of digital currencies operates within a framework that promotes trust, transparency, and stability.

The adoption of the MiCA crypto regulation is not just a regulatory milestone; it’s a transformative movement that reshapes how digital assets are managed, traded, and perceived in one of the world's largest economies. With this new era comes a host of opportunities and challenges for stakeholders in the crypto market. As the EU embraces this change, understanding the nuances of MiCA becomes crucial for anyone involved in the crypto space – from seasoned investors to emerging fintech enterprises.

Understanding MiCA Crypto Regulation

The MiCA crypto regulation, a cornerstone of the EU's approach to digital assets, heralds a new chapter in the governance of the crypto market. This regulatory framework is designed with the primary aim of safeguarding investors and ensuring market integrity, a crucial step given the volatile nature of cryptocurrencies. MiCA crypto regulation establishes a standardized set of rules across EU member states, addressing key areas such as operational resilience, consumer protection, and market transparency.

One of the standout features of the MiCA framework is its comprehensive coverage. It extends to various forms of crypto-assets, including tokens, stablecoins, and digital wallets, ensuring that all aspects of crypto asset management fall under its purview. This broad scope is vital in a market known for its diversity and rapid innovation.

Moreover, MiCA crypto regulation introduces rigorous requirements for service providers in the crypto market. These entities must adhere to strict operational and organizational standards, ensuring that they can withstand market shocks and protect consumer assets. This aspect of MiCA is crucial, as it brings a level of security to the crypto market that was previously lacking, building trust among investors and users.

The regulation also emphasizes the importance of transparency. Under MiCA, issuers of crypto-assets are required to provide detailed whitepapers, offering clear and comprehensible information about their products. This transparency is key to empowering investors, allowing them to make informed decisions based on reliable data.

In essence, the MiCA framework is not just about imposing restrictions; it's about fostering a stable and trustworthy environment where crypto assets can thrive in a regulated and secure ecosystem. This balance between innovation and regulation is what sets MiCA apart, paving the way for a more resilient and mature crypto market within the EU.

Impact on Crypto Asset Management

The MiCA crypto regulation framework significantly alters the landscape of crypto asset management in the EU, offering both challenges and opportunities. A key impact is the heightened sense of security for investors. By standardizing regulatory practices across member states, MiCA mitigates the risks associated with crypto investments, such as fraud and market manipulation. This increased security is likely to boost investor confidence, potentially attracting more mainstream and institutional investors to the crypto market.

For crypto service providers, MiCA mandates a robust compliance framework. While this might initially seem burdensome, it ultimately benefits these entities by enhancing their credibility and reputation. Compliant firms are seen as more reliable and trustworthy, which can be a competitive advantage in attracting customers who are cautious about entering the crypto space.

Another significant impact of MiCA is on market stability. The regulation's emphasis on transparency and accountability helps in reducing market volatility, a characteristic often associated with cryptocurrencies. By requiring clear disclosures and responsible financial practices, MiCA contributes to a more predictable and stable market environment.

However, MiCA also poses some operational challenges. Adapting to new regulatory requirements demands resources and efforts, particularly for smaller firms. Nonetheless, this compliance effort is a strategic investment in building a sustainable business model in a rapidly evolving industry.

Kyrrex: MiCA crypto regulation in Banking and Neobanking

In the context of the MiCA regulation, the role of neobanking in crypto asset management gains new significance. Neobanking, a modern form of banking that operates exclusively online without traditional physical branch networks, is rapidly becoming a key player in the financial technology sector. These digital banks offer innovative financial services, including those related to cryptocurrencies, aligning well with the digital and dynamic nature of crypto assets.

The advent of MiCA brings neobanks into the spotlight, as they are well-positioned to adapt quickly to the new regulatory requirements due to their digital-first approach. This agility makes neobanks an attractive option for both retail and institutional clients looking to manage their crypto assets in a compliant and user-friendly environment.

Kyrrex, a leader in the digital finance space, exemplifies this synergy between neobanking and MiCA compliance. With a focus on integrating the flexibility of digital banking with the security and compliance demands of MiCA, Kyrrex MiCA banking services stand out. The company offers innovative solutions that comply with MiCA regulations, ensuring that clients can manage their crypto assets confidently and securely.

Kyrrex’s Whitelabel solutions, in particular, are tailored to meet the needs of businesses seeking to enter the crypto market or expand their existing offerings. These solutions are designed not only to be compliant with MiCA regulations but also to provide a seamless and efficient banking experience. This blend of regulatory adherence and innovative banking solutions positions Kyrrex as a frontrunner in the EU's evolving crypto landscape.

Future of Crypto Asset Management in the EU

The implementation of the MiCA crypto regulation framework in the EU is not just a regulatory update; it's a catalyst for innovation and growth in the crypto asset management sector. As the industry aligns with these new standards, we can expect to see an evolution in how crypto assets are managed, traded, and perceived.

One of the key changes will be the increased institutional participation. With a clearer regulatory environment, traditional financial institutions are more likely to enter the crypto space, bringing with them a wave of professional expertise and capital. This infusion is expected to boost the market's maturity and liquidity.

Another area of potential growth is in the development of new crypto-related products and services. As compliance with MiCA becomes the norm, businesses will have a stable platform to innovate while adhering to regulatory standards. This could lead to an expansion in services like crypto-based lending, staking, and novel investment products tailored to meet the needs of a diverse range of investors.

Additionally, the MiCA framework might encourage more robust cross-border collaborations within the EU. The harmonization of regulations across member states can facilitate smoother transactions and partnerships, fostering a more interconnected European crypto ecosystem.

In conclusion, the MiCA regulation is set to reshape the landscape of crypto asset management in the EU, fostering a more stable, trustworthy, and innovative market. This regulatory framework, by providing clarity and security, lays the groundwork for a thriving and sustainable crypto economy within the European Union.

How White Label for Telegram Crypto Bots Make Additional Income Possible

Innovative solutions are continually emerging to cater to the needs of traders and investors. One such solution that has gained considerable attention is the White Label Telegram crypto bot. This technology not only enhances the trading experience for users but also presents an avenue for platforms to generate additional income through various channels. This article sheds light on the economic advantages of deploying white label solutions, providing valuable insights for platforms looking to maximize their earning potential.

Understanding White Label Telegram Crypto Bots

White Label Telegram crypto bots have become a game-changer for both cryptocurrency enthusiasts and platforms seeking to enhance their offerings. These bots, built on the popular messaging platform Telegram, empower users to execute trades, access real-time market data, and manage their portfolios seamlessly. According to research by Binance Research, the cumulative trading volume via Telegram crypto bots exceeded $190 million by early August 2023 with the highest daily record standing at $10m. This is testament to an evolving phenomenon that is likely to keep increasing in profile.

What sets White Label Telegram crypto bots apart is their customization feature, allowing platforms to rebrand and tailor the bot's functionalities to suit their brand identity and user preferences. This level of customization fosters a sense of trust and familiarity among users, leading to increased engagement and adoption.

Revenue Generation Avenues for Platforms that Embrace White Label Telegram Crypto Bot Solutions

Trading Commissions

One of the primary ways platforms benefit from incorporating White Label Telegram crypto bots is through trading commissions. The report by Binance Research found that these crypto bots have collected more than $28 million, in all-time revenue.

As users actively trade cryptocurrencies via the bot, platforms can charge a percentage of each transaction as a fee. This model not only establishes a recurring source of income but also aligns the platform's success with the traders' profitability. The more trades are executed through the bot, the more income the platform generates.

The convenience offered by these bots also contributes to higher trading volumes. Users can access real-time market data, set automatic trading strategies, and execute trades without leaving the Telegram app. This streamlined process encourages more frequent trading activities, ultimately translating into higher trading volumes and increased revenue for the platform.

Operational Efficiencies and Cost Savings

White Label Telegram crypto bots not only drive revenue through trading commissions but also improve operational efficiencies for platforms. These bots automate several tasks, such as account management, trade execution, and real-time market analysis. By reducing the need for manual intervention, platforms can save on human resources and operational costs.

Additionally, the bots' 24/7 availability ensures that users can engage with the platform at any time, regardless of their geographical location. This round-the-clock accessibility leads to increased user satisfaction and engagement, which, in turn, contributes to a higher retention rate and more opportunities for generating income.

Premium and Subscription Services

Beyond trading commissions and operational efficiencies, White Label Telegram crypto bots open the door to exploring additional revenue streams. Platforms can offer premium features or subscription-based services to users who wish to access advanced trading strategies or personalized alerts. This not only caters to a diverse range of users but also allows platforms to monetize their expertise and knowledge in the cryptocurrency space.

Affiliate Programs

White Label Telegram crypto bots also present an opportunity for platforms to establish affiliate programs. By partnering with other platforms or businesses in the cryptocurrency ecosystem, platforms can earn referral fees or commissions for every user they bring in. This not only expands the platform's user base but also creates an additional income stream through strategic partnerships.

Value-Added Services

One of the primary ways platforms can earn regular income through White Label Telegram crypto bots is by offering various operational services. These services may include account management, customer support, and technical assistance. By providing these value-added services, platforms can charge a fee or subscription, thereby creating a steady revenue stream.

Token Integration and ICO Launches

For platforms that have their native tokens or plan to launch an Initial Coin Offering (ICO), White Label Telegram crypto bots can play a crucial role in generating income. These bots can be integrated with the platform's token, allowing users to trade, buy, or sell the token directly through the bot. Additionally, during an ICO launch, the bot can facilitate the token sale process, ensuring a seamless experience for investors and generating funds for the platform.

Market Data and Analytics

White Label Telegram crypto bots can also serve as a valuable tool for platforms to gather market data and analytics. By analyzing user behavior, trading patterns, and market trends, platforms can gain valuable insights that can be monetized. This data can be used to offer premium analytics services, market reports, or even sold to third-party companies interested in cryptocurrency market research.

How Platforms Using White Label Telegram Crypto Bot Solutions Can Boost Revenue

While the avenues for platforms to generate revenue via Telegram crypto bots are many, profitability is not a fait accompli. Platforms that are serious about turning their branded crypto Telegram bots into a money-making machine must create an enabling and highly adaptive environment that organically attracts users and avoids legal and operational issues. The choice of white label solution to deploy plays an important role.

Navigating the Regulatory Landscape

Although the potential for additional income through White Label Telegram crypto bots is promising, it's crucial for platforms to navigate the regulatory landscape and prioritize security. Cryptocurrency regulations vary from region to region, and platforms must ensure compliance with local laws to maintain a legitimate and sustainable operation. This may involve implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to create a safe and transparent trading environment.

That is why choosing the right White Label Crypto solution is crucial. Kyrrex White Label relies on its years of experience navigating the complex environment of regulation and licensing to provide bespoke products that take care of license requirements, allowing clients to focus on the operational side of things.

Ensuring Security

Security is paramount in the cryptocurrency space. With the rising threat of cyberattacks and hacking incidents, platforms must invest in robust security measures to safeguard user funds and data. Implementing multi-factor authentication, cold storage solutions, and regular security audits will not only protect the platform's reputation but also enhance user trust, leading to greater adoption and, consequently, increased income opportunities.

Leveraging Data Analytics for Growth

An inbuilt advantage of integrating White Label Telegram crypto bots is the access to valuable data analytics. These bots collect and analyze user behavior, trading patterns, and preferences. Platforms can leverage this data to gain insights into user engagement, identify popular trading pairs, and optimize their services based on user feedback. By making informed decisions, platforms can enhance user satisfaction, attract new traders, and consequently drive up trading volumes and associated income.

Creating a Supportive Community

The success of any platform is intricately tied to its community of users. White Label Telegram crypto bots facilitate the creation of an engaged and supportive community. Platforms can use the bot to provide real-time customer support, offer educational content, and foster discussions around market trends and investment strategies. A vibrant community not only enhances user retention but also attracts new traders through positive word-of-mouth referrals, thereby contributing to increased income potential.

Adapting to Market Trends

The cryptocurrency market is dynamic, characterized by rapidly evolving trends and technologies. Platforms that offer White Label Telegram crypto bots position themselves to adapt to these changes efficiently. The customization feature of these bots enables platforms to quickly implement updates, integrate new features, and stay relevant in a competitive landscape. By staying ahead of the curve, platforms can attract a loyal user base, maintain high engagement levels, and secure a steady flow of income

Last Word

Innovation and adaptability are paramount for sustained growth and profitability in the crypto market. The incorporation of White Label Telegram crypto bots offers platforms a multifaceted approach to generating additional income. Through trading commissions, operational efficiencies, diversification of revenue streams, and engagement enhancement, platforms can establish themselves as leaders in the industry while catering to the evolving needs of their users.

However, it's important to approach this opportunity with careful consideration of regulatory compliance and security measures. By prioritizing user trust and safety, platforms can build a solid foundation for their operations. Moreover, data analytics and community-building efforts provide invaluable insights and growth opportunities that can further bolster income potential.

As the cryptocurrency landscape continues to evolve, platforms that harness the power of White Label Telegram crypto bots demonstrate a commitment to innovation, user satisfaction, and financial success. By embracing these solutions, platforms can navigate the complexities of the market, adapt to changing trends, and ultimately tap into the vast potential for additional income.

How Do Crypto Liquidity Providers Work?

Ever wondered who keeps the gears turning in the fast-paced world of cryptocurrencies? How do crypto liquidity providers work, and what role do they play in ensuring a smooth and stable market for digital assets? In this blog post, we’ll explore the world of crypto liquidity providers, their various types, the incentives they receive, the challenges they face, and how one can become a crypto liquidity provider. Let’s dive in!

Short Summary

- Crypto Liquidity Providers facilitate liquid markets and enhance price stability by providing adequate liquidity.

- They are incentivized to participate in the market through fee reductions, rebates and rewards, and exclusive programs offered by exchanges.

- To become a crypto liquidity provider one must assess their trading strategy, choose an exchange, and manage associated risks.

The Role of Crypto Liquidity Providers

In both traditional financial markets and the cryptocurrency market, liquidity providers play a crucial role in maintaining an efficient and stable trading environment. They ensure smooth trading operations by facilitating a liquid market, enhancing price stability, and reducing price slippage.

But what exactly is liquidity, and why is it so important for the market? In a nutshell, liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. High liquidity in the market ensures that there are enough buyers and sellers to satisfy the demand for liquid assets, which in turn helps maintain stable prices.

Now, let’s take a closer look at the different ways crypto liquidity providers contribute to market stability.

Facilitating Smooth Trading

Crypto liquidity providers play a pivotal role in ensuring seamless trading by guaranteeing liquidity in the market, pairing buyers and sellers, and providing an uninterrupted supply of digital assets. They maintain the availability of both buy and sell orders in the market, making it easier for traders to execute their trades without any significant delays or disruptions. This is particularly crucial in the cryptocurrency market, where low liquidity can result in high volatility and drastic price changes, creating an illiquid market with increased risks for traders and investors.

In essence, liquidity providers act as the backbone of the market, ensuring that there are enough buy and sell orders to keep the gears turning. By providing liquidity, they help create a smooth trading experience for market participants, reducing the likelihood of drastic price fluctuations that can occur when dealing with illiquid assets.

So, how do they contribute to price stability in the market?

Enhancing Price Stability

Price stability is an essential aspect of any healthy market, and liquidity providers play a significant role in maintaining it. By injecting buy and sell orders into the market, they help maintain an equilibrium market price that is satisfactory to all parties involved. In a market with high liquidity, even large trades have a minimal impact on asset prices, ensuring a more stable trading environment.

Reduced liquidity, on the other hand, can result in substantial price fluctuations, as even minor shifts in supply or demand can have a considerable influence on prices. To counteract this, crypto liquidity providers actively inject buy and sell orders into the market, effectively maintaining price stability and creating a more efficient trading environment.

Reducing Price Slippage

Price slippage is the discrepancy between the anticipated price of a trade and the actual price at which the trade is executed. Low liquidity or high volatility in the market can result in significant changes in price. This can have a damaging effect on investments. Crypto liquidity providers are integral in mitigating price slippage by ensuring adequate liquidity in the market, enabling traders to purchase or sell assets promptly and at a reasonable price.

By providing liquidity, crypto liquidity providers assist in minimizing the discrepancy between the projected price and the executed price, thereby reducing the possibility of slippage. This ensures that traders can execute their trades quickly and efficiently, without having to worry about significant deviations from their anticipated prices.

Now that we’ve seen the critical role liquidity providers play in the market, let’s explore the different types of crypto liquidity providers.

Types of Crypto Liquidity Providers

There are several types of crypto liquidity providers, each with their unique strategies and approaches to providing liquidity in the market. Broadly speaking, crypto liquidity providers can be classified as:

- Institutional liquidity providers

- Liquidity providers on decentralized exchanges (DEXs) and automated market makers (AMMs)

- Companies or entities offering buy and sell-side liquidity to cryptocurrency exchanges.

Institutional Liquidity Providers

Often referred to as ILPs, they play a pivotal role in the financial markets. They are typically large financial institutions, such as banks, investment firms, or specialized market makers, that offer substantial liquidity to support trading activities. Institutional Liquidity Providers facilitate smooth and efficient market operations by buying and selling financial instruments, including stocks, bonds, currencies, and cryptocurrencies, on a large scale.

The presence of ILPs enhances market stability, ensures competitive pricing, and provides valuable liquidity for institutions and retail traders alike.

Liquidity Providers on DEXs and Automated Market Makers (AMMs)

This type of liquidity provider is vital in the world of decentralized finance (DeFi). These individuals or entities contribute assets to liquidity pools, allowing users to trade directly on DEX platforms.

By doing so, liquidity providers enable the seamless exchange of cryptocurrencies while earning fees and rewards in return.

Companies Offering Buy and Sell-side Liquidity

These companies are instrumental in ensuring cryptocurrency platforms operate smoothly and efficiently. They enhance market depth, reduce spreads, and foster a vibrant trading environment, ultimately benefiting both traders and exchanges. They do this by providing enough liquidity on request so trading at any volume can proceed smoothly and efficiently.

An example is Kyrrex White Label. One of their products, the Kyrrex Liquidity Hub, is designed to ensure seamless liquidity management by client platforms. Kyrrex empowers exchanges to offer a superior trading experience. If you're seeking a liquidity solution that can elevate your exchange's performance, it's time to explore Kyrrex Liquidity Hub and discover the difference it can make for your platform.

All types of liquidity providers can also be grouped into 3: market makers, arbitrageurs and algorithmic traders, based on their method of providing liquidity. Let’s take a closer look at each of these types.

Market Makers

Market makers are entities that generate buy and sell orders to ensure a liquid market, profiting from the bid-ask spread. They play a crucial role in both traditional stock markets and cryptocurrency markets by providing liquidity and ensuring efficient market operations. By buying securities from sellers and selling securities to buyers, they help maintain a seamless flow of assets in the stock market.

Market makers benefit from the difference between the buy and sell prices they quote, referred to as the bid-ask spread. By quoting both buy and sell prices, they are able to capitalize on the spread and generate a profit.

Next, let’s examine the role of arbitrageurs in providing liquidity.

Arbitrageurs

Arbitrageurs are market participants who:

- Take advantage of price discrepancies between different exchanges or trading pairs

- Capitalize on price discrepancies to purchase and sell the same asset at varying prices

- Contribute to market liquidity

- Help maintain a smooth and efficient market by ensuring that asset prices remain consistent across different trading platforms.

This process of exploiting price differences not only benefits arbitrageurs themselves, but also contributes to overall market stability by eliminating pricing inefficiencies and ensuring that asset prices remain consistent across different exchanges.

Lastly, let’s explore the world of algorithmic traders.

Algorithmic Traders

Algorithmic traders are individuals who employ automated trading strategies to provide liquidity, typically reacting to market signals and trends. By using advanced mathematical models and computer programs, these traders can make informed trading decisions in the financial markets. Algorithmic traders employ automated trading strategies to purchase and sell assets, thus providing liquidity to the market.

Furthermore, these traders often utilize advanced algorithms to analyze market signals and trends, allowing them to capitalize on opportunities and provide liquidity more efficiently. Now that we’ve explored the different types of crypto liquidity providers, let’s discuss the incentives they receive for their efforts.

Incentives for Crypto Liquidity Providers

Crypto liquidity providers are offered a variety of incentives to encourage their continued participation in the market. These incentives can include fee reductions, rebates and rewards, as well as exclusive programs offered by exchanges.

Let’s delve deeper into each of these incentives.

Fee Reductions

Exchanges often offer reduced fees to liquidity providers as an incentive to engage in the market. These fee reductions can take the form of higher maker fee rebates or reduced trading fees for liquidity providers. By offering lower fees, exchanges encourage participation from liquidity providers, ensuring a more liquid and efficient market for all traders.

Utilizing limit orders and adding liquidity to the market can also help traders reduce their overall trading costs, further incentivizing their participation as liquidity providers.

Rebates and Rewards

Rebates and rewards are another form of incentive offered to crypto liquidity providers. These incentives may be based on the liquidity provider’s trading volume or other performance metrics. By offering attractive rebates and rewards, exchanges encourage the provision of liquidity, ensuring a more efficient trading environment for all users.

Additionally, liquidity providers may be eligible for rewards based on their relative share of liquidity or receive additional incentives such as tokens or fees.

Special Programs

Special programs, such as Binance’s Liquidity Provider Programs, are designed to support and incentivize liquidity providers in the crypto market. These programs offer various benefits to liquidity providers, such as higher maker fee rebates, higher API limits, and low-latency connectivity services. By participating in these programs, liquidity providers can enjoy reduced trading fees, attractive rebates related to market-making activity and trading volume, and an improved trading environment for all users on the platform.

In summary, fee reductions, rebates and rewards, and special programs are all crucial incentives that encourage liquidity providers to continue contributing to the market’s efficiency and stability. However, being a crypto liquidity provider is not without its challenges.

Challenges Faced by Crypto Liquidity Providers

Crypto liquidity providers face several challenges in their quest to ensure smooth and stable markets. Some of these challenges include market volatility, regulatory uncertainty, and technology and security risks.

Let’s examine each of these challenges in more detail.

Market Volatility

Market volatility can make it difficult for liquidity providers to maintain stable prices and manage risks. In the cryptocurrency market, market volatility is often attributed to the abundance of buyers and sellers, the lack of regulation, and the lack of liquidity. Crypto liquidity providers are exposed to a variety of risks when confronted with market volatility, such as the risk of adverse selection, the risk of cross-sectional variation in liquidity, and the risk of price slippage.

To manage market volatility, liquidity providers can employ a variety of strategies, such as hedging, diversifying their portfolios, and utilizing algorithmic trading strategies. Additionally, they can use stop-loss orders and limit orders to restrict their exposure to market volatility. By closely monitoring trading volumes, liquidity providers can better adapt their strategies to changing market conditions.

Regulatory Uncertainty

Regulatory uncertainty in the cryptocurrency space can create challenges for liquidity providers, including:

- Compliance and potential legal issues

- Increased risk and volatility

- Difficulty in evaluating and managing exposure

- Restricted access to banking services

- Augmented compliance costs

These factors can significantly impact the capacity of liquidity providers to function effectively, especially when dealing with less liquid assets.

To reduce the risks associated with regulatory uncertainty, liquidity providers can stay abreast of regulatory developments, engage with regulators, and utilize technology to automate compliance processes.

Lastly, let’s discuss the technology, security, and liquidity risk that liquidity providers must manage.

Technology and Security Risks

Technology and security risks, such as hacking and system failures, can pose significant threat to liquidity providers’ operations and assets. These risks can be categorized into four main types:

- Operational risks: These involve the potential for system failure, data loss, and other operational issues.

- Technology risks: These involve the possibility of cyber-attacks, hacking, and other malicious activities.

- Custody risks: These involve the potential for theft or misappropriation of assets.

- Security risks: These involve the possibility of unauthorized access to systems and data.

To safeguard against these risks, liquidity providers must have robust security measures in place to ensure the security of their systems and the protection of their data.

Now that we’ve explored the challenges faced by crypto liquidity providers, let’s discuss how one can become a crypto liquidity provider.

How to Become a Crypto Liquidity Provider

Becoming a crypto liquidity provider involves several steps, including assessing your trading strategy, choosing an exchange, and managing risks.

Let’s delve deeper into each of these steps.

Assessing Your Trading Strategy

Before becoming a crypto liquidity provider, it is essential to evaluate your trading strategy to ensure that you can effectively provide liquidity in the market. Factors to consider include:

- The type of trading you intend to pursue

- The capital available

- Your risk tolerance

- The amount of time you can commit to trading

Taking these factors into consideration will help you determine if becoming a liquidity provider is the right choice for you.

A well-developed trading strategy should take into account market conditions, potential opportunities, and risk management techniques. By carefully assessing your trading strategy, you can ensure that you are well-equipped to provide liquidity in the cryptocurrency market.

Next, let’s discuss the process of choosing an exchange, including centralized exchanges.

Choosing an Exchange

Choosing the right exchange is crucial, as different exchanges may offer varying incentives and support for liquidity providers. When selecting an exchange, it is important to consider factors such as:

- The fees charged

- The security measures implemented

- The liquidity of the exchange

- The customer support available.

By carefully evaluating these factors, you can select an exchange that best aligns with your goals and objectives as a liquidity provider. Once you have chosen an exchange, the final step in becoming a crypto liquidity provider is managing risks.

Managing Risks

Managing risks is an essential aspect of being a successful crypto liquidity provider. Some of the risks you may need to manage include:

- Market volatility

- Regulatory uncertainty

- Technology and security risks

- Counterparty risk

To effectively manage these risks, you should consider the following steps:

- Risk identification

- Risk assessment

- Risk treatment

- Risk monitoring and reporting

By proactively managing these risks, you can ensure the success of your operations as a crypto liquidity provider and contribute to a more stable and efficient market.

Summary

Throughout this blog post, we have explored the vital role of crypto liquidity providers in maintaining a stable and efficient market, the different types of liquidity providers, the incentives they receive, and the challenges they face. We also discussed the steps to become a crypto liquidity provider, including assessing your trading strategy, choosing an exchange, and managing risks. By understanding the intricacies of providing liquidity in the cryptocurrency market, you can contribute to a more efficient and stable trading environment for all participants. So, are you ready to dive into the world of crypto liquidity provision and help shape the future of digital asset trading?

Frequently Asked Questions

How much do liquidity providers make crypto?

Liquidity providers can earn transaction fees on decentralized exchanges, such as Uniswap, at a rate of around 0.3%. This fee is usually equivalent to about a 25% annual interest rate.

With lower fees available for stable assets and higher rates available for more exotic pairs, liquidity providers can make good money from providing crypto services.

How does a liquidity provider work?

A liquidity provider deposits assets into a pool to facilitate trades on DEXs and AMMs, earning Liquidity Pool Tokens (LP) in return. These tokens are also called liquidity provider tokens.

Can you make money being a liquidity provider?

You can make money being a liquidity provider by earning transaction fees from trades within the liquidity pool or by yield farming. Liquidity providers get rewarded in proportion to the amount of crypto assets they stake, allowing them to generate extra income with minimal effort.

What are the risks of crypto liquidity provider?

Liquidity providers face the risk of an impermanent loss due to sharp price fluctuations in the tokens they provide liquidity for. This occurs when one token in the pool increases or decreases more than the other, leading to losses for the liquidity provider.

The risk of impermanent loss can be mitigated by diversifying the liquidity pool, using stop-loss orders, and monitoring the market closely. Additionally, liquidity providers can use automated strategies to manage their risk.

What is liquidity in Crypto?

Liquidity in cryptocurrency refers to the ease and speed with which digital assets can be bought and sold near their market prices. Cryptocurrency investors must assess a coin’s liquidity before investing, as low liquidity can result in significant price volatility.

Maximizing Profits: Innovative Ways of Monetizing Your Crypto Exchange

Finding innovative ways to monetize your platform is crucial for the long-term success of a cryptocurrency exchange. In this article, we will explore diverse monetization strategies that can help you maximize profits and stay ahead of the competition.

Standard Revenue-Generation Strategies

These are popular methods of revenue generation for crypto exchanges. Most centralized exchanges, in their various forms, deploy some or all of the methods here to make money and keep the platform running.

1. Trading Fees and Commissions

One of the most common ways to monetize a crypto exchange is through trading fees and commissions. According to Nasdaq, trading fees on most cryptocurrency exchanges range between 0% and 1.5% per trade. By charging a small percentage of each transaction, you can generate a steady stream of revenue. However, it's important to strike a balance between competitive fees and sustainable profitability. Conducting market research to understand the fee structures of your competitors can help you determine the optimal pricing strategy for your exchange.

2. Premium Features and Subscriptions

Offering premium features and subscription plans can be an effective way to monetize your crypto exchange. By providing additional benefits such as advanced trading tools, real-time market data, or priority customer support, you can attract users who are willing to pay for enhanced services. Conducting user surveys and analyzing customer feedback can help you identify the most valuable features to include in your premium plans.

3. Token Listing Fees

As the crypto market continues to expand, listing fees for new tokens have become a significant source of revenue for exchanges. By charging a fee for listing tokens on your platform, you can generate income from projects seeking exposure to your user base. However, it's important to conduct thorough due diligence on each token to maintain the integrity of your exchange and protect your users from potential scams.

4. Affiliate and Referral Programs

Implementing affiliate and referral programs can be a win-win strategy for both your exchange and your users. By incentivizing users to refer new customers to your platform, you can expand your user base while rewarding your existing users. Offering referral bonuses, discounts on trading fees, or even revenue sharing can motivate users to actively promote your exchange. Tracking and analyzing referral data can help you optimize your program and maximize its effectiveness.

5. Margin Trading and Lending

Introducing margin trading and lending services can open up new revenue streams for your crypto exchange. According to data from CoinMarketCap, the top 5 crypto derivatives exchanges alone process more than $50 billion in daily volume, highlighting its status as a money spinner. By allowing users to trade with borrowed funds or lend their assets to others, you can earn interest or fees on these transactions. However, it's important to implement robust risk management measures and educate your users about the potential risks associated with margin trading and lending.

6. Initial Exchange Offerings (IEOs)

IEOs have gained popularity as a fundraising method for blockchain projects. By hosting IEOs on your exchange, you can charge listing fees and earn a percentage of the tokens sold during the fundraising event. However, it's crucial to conduct thorough due diligence on the projects and ensure compliance with regulatory requirements to protect your users and maintain the reputation of your exchange.

7. NFT Marketplaces

The rise of non-fungible tokens (NFTs) has opened up new opportunities for crypto exchanges to monetize their platforms. By creating an NFT marketplace or partnering with existing ones, you can facilitate the buying, selling, and trading of digital collectibles, artwork, and other unique assets. Charging transaction fees or taking a percentage of each NFT sale can generate revenue while tapping into the growing interest in this emerging market.

Secondary Methods of Revenue Generation for Crypto Exchange Platforms

This is where innovation and a coherent business strategy play a key role. The precise methods chosen to augment revenue for your crypto exchange will vary depending on the type of exchange, its target audience, market sentiment, regulatory environment and other factors.

1. Strategic Partnerships and Sponsorships

Collaborating with other companies in the crypto industry through strategic partnerships and sponsorships can provide additional revenue opportunities. By partnering with established projects or sponsoring industry events, you can increase brand visibility and attract new users to your exchange. It's important to choose partnerships that align with your brand values and target audience to ensure a mutually beneficial relationship.

2. Using a Turnkey Solution

Using a turnkey or white label solution instead of building a crypto platform from scratch can be a strategic move that helps you maximize revenue. By leveraging a pre-built solution like Kyrrex White Label, platforms can save valuable time and resources that would otherwise be spent on development, testing, and maintenance. This allows you to focus on your core competencies, such as marketing, customer acquisition, and enhancing the user experience. Additionally, a turnkey solution provides access to a proven infrastructure, advanced trading features, and security measures that have been refined over time. This not only accelerates the platform's time to market but also instills confidence in users, attracting a larger user base and increasing trading volume. By deploying a turnkey solution like Kyrrex White Label, you can minimize upfront costs and streamline operations, thereby allocating more resources towards monetization strategies, such as trading fees, premium features, and partnerships, ultimately maximizing your revenue potential.

3. Educational Resources and Courses

Positioning your crypto exchange as a trusted source of knowledge and education can be a valuable monetization strategy. By offering educational resources, tutorials, and online courses on topics such as blockchain technology, cryptocurrency trading strategies, or security best practices, you can attract users who are willing to pay for premium educational content. This not only generates revenue but also enhances your brand reputation as an authority in the industry.

4. Sponsored Content and Advertising

Partnering with relevant brands and projects to display sponsored content or advertisements on your exchange platform can be a lucrative monetization strategy. By carefully selecting partners that align with your target audience and maintaining transparency about sponsored content, you can generate revenue while providing value to your users. However, it's important to strike a balance between monetization and user experience to avoid overwhelming your users with excessive advertising.

5. Data Analytics and Insights

Leveraging the data generated by your crypto exchange can provide valuable insights that can be monetized. By analyzing trading patterns, market trends, and user behavior, you can offer data analytics services or sell aggregated data to researchers, institutional investors, or other market participants. Ensuring data privacy and compliance with regulations is crucial when exploring this monetization avenue.

6. Community Building and Events

Building a strong community around your crypto exchange can create opportunities for monetization. By organizing virtual or physical events, meetups, or conferences, you can bring together industry experts, thought leaders, and enthusiasts. Charging ticket fees, securing sponsorships, or offering premium access to exclusive networking opportunities can generate revenue while fostering a sense of belonging and loyalty among your community members.

7. Cross-Promotion and Partnerships

Collaborating with other crypto projects or exchanges through cross-promotion and partnerships can be mutually beneficial. By featuring each other's platforms, sharing user bases, or offering joint promotions, you can expand your reach and attract new users. This can be monetized through revenue-sharing agreements or by leveraging the increased user base to drive more trading activity on your exchange.

Final Words

Being able to successfully monetize your crypto platform is essential for long-term success. By implementing a combination of trading fees, premium features, token listing fees, affiliate programs, margin trading, IEOs, strategic partnerships and secondary avenues of generating revenue, you can maximize profits and ensure the financial stability of your crypto exchange. However, it's important to continuously monitor market trends, analyze user feedback, and adapt your monetization strategies to stay ahead of the competition. Remember, the key to success lies in understanding your target audience, providing value-added services, and maintaining a strong brand image in the crypto community.

How Much Does It Cost to Create a Bitcoin Exchange?

Have you ever dreamt of creating your own Bitcoin exchange platform in the thriving cryptocurrency market? Imagine being at the forefront of the market, facilitating peer-to-peer cryptocurrency transactions while earning transaction fees. But how much does it cost to create a Bitcoin exchange? In this blog post, we will break down the various factors influencing the cost of creating a Bitcoin exchange, from development to marketing strategies.

Short Summary

- The cost of a Bitcoin exchange platform is determined by factors such as development costs, security measures, licensing and compliance requirements.

- Key components include trading engine, user interface/experience and wallet integration.

- Alternatives to custom development are white label solutions or clone scripts for quick launch at lower cost.

Determining the Cost of a Bitcoin Exchange Platform

The cost of creating a Bitcoin exchange depends on various factors, including:

- Development costs

- Security measures

- Licensing and compliance requirements

- Size of the development team

- Estimated growth rate of the global cryptocurrency market

All of these factors play a crucial role in determining the overall cost of crypto exchange platforms, as well as the individual cost of a crypto exchange platform.

The tools and technologies employed, such as traditional development approaches or cloud-based solutions, can also significantly impact the crypto exchange development cost.

Development Costs

The cryptocurrency exchange development cost can range from $50,000 to $150,000, depending on the complexity and features of the platform. This includes hiring a development team, implementing necessary features, and ensuring platform scalability.

Scalability is essential to guarantee that the platform is prepared to accommodate the volume of thousands of active users with millions of cryptocurrency transactions occurring daily.

Security Measures

Security measures are a critical aspect of any crypto exchange, as they protect user data and funds. Implementing robust security protocols, encryption, and two-factor authentication are essential factors in creating a secure and reliable exchange platform.

For example, Coinbase, one of the leading crypto exchanges, employs a comprehensive security system to safeguard customer funds. This includes:

- Storing 98% of funds offline

- Distributing bitcoins across multiple secure deposit boxes and vaults

- Disconnecting data from the internet

- Implementing a two-step verification process

Licensing and Compliance

Licensing and compliance costs depend on the jurisdiction and regulatory requirements for operating a cryptocurrency exchange business. It is essential to obtain a crypto exchange licence and implement anti-money laundering strategies and know-your-customer (KYC) procedures.

Moreover, it is advisable to seek legal counsel to guarantee that all licensing requirements are fulfilled.

Key Components of a Bitcoin Exchange

A successful Bitcoin exchange comprises key components such as a trading engine, user interface and experience, and wallet integration. These components are crucial for providing a seamless and user-friendly platform that can handle the vast number of cryptocurrency transactions on cryptocurrency exchanges and attract users to the exchange.

Trading Engine

The trading engine is the central component of a crypto trading platform, responsible for executing trading transactions on the cryptocurrency market, matching buy and sell orders, and ensuring the proper functioning of internal processes. With an efficient trading engine in place, users can execute transactions seamlessly and enjoy a smooth trading experience.

The trading engine is the backbone of the exchange platform, and its performance is critical for the exchange.

User Interface and Experience

A user-friendly interface and seamless user experience are crucial for attracting and retaining users on a Bitcoin exchange platform. The user interface and experience component encompasses:

- Graphical user interface

- Trading platform design

- Navigation

- Responsiveness

- User-friendliness

By offering a smooth and intuitive trading experience, users are more likely to have a positive experience with the platform and continue using it.

User experience is a key factor in the success of any Bitcoin exchange platform.

Wallet Integration

Wallet integration allows users to securely store, send, and receive digital currencies, including their own cryptocurrency, on the cryptocurrency exchange platform. This involves integrating cryptocurrency wallets into the exchange platform, thus enabling users to effectively manage their crypto assets and execute transactions on the blockchain network.

Wallet integration can be achieved either by developing a wallet from the ground up or integrating existing third-party wallets.

Blockchain Technology and Infrastructure

Building a blockchain technology infrastructure for a Bitcoin exchange can be accomplished using existing blockchain infrastructure solutions or custom development. Blockchain technology utilizes a decentralized network of computers that maintain a shared ledger of all Bitcoin transactions. This infrastructure guarantees the security, transparency, and immutability of the transactions on the exchange platform.

By leveraging the power of blockchain technology, Bitcoin exchanges can ensure that their customers’ funds are protected.

Existing Blockchain Solutions

Existing blockchain solutions offer cost-effective and time-saving options for building a Bitcoin exchange. Some popular existing blockchain solutions include:

- Ethereum

- Hyperledger

- EOS

- BitShares

- Chainlink

By utilizing these solutions, developers can save time and resources, allowing them to focus on other aspects of the platform, such as user interface and marketing strategies.

Custom Blockchain Development

Custom blockchain development allows for greater flexibility and customization, but may require more time and resources. The process of custom blockchain development involves:

- Defining the requirements of the exchange platform

- Designing the architecture of the blockchain solution

- Developing the code

- Testing the code

- Deploying the solution

Although custom blockchain development can be more costly than existing blockchain solutions, the potential benefits of increased security and scalability may outweigh the additional costs.

Marketing and User Acquisition Strategies

Marketing and user acquisition strategies are essential for driving traffic and increasing the user base on a Bitcoin exchange platform. Employing strategies such as:

- SEO

- Content marketing

- Social media marketing

- Email marketing

- Influencer marketing

- Referral programs

Can help attract users and grow the exchange.

Some successful examples of marketing and user acquisition strategies include Coinbase’s referral program and Binance’s influencer marketing campaign, which helped these companies gain millions of users.

Digital Marketing Campaigns

Digital marketing campaigns, including social media, content marketing, and paid advertising, can help attract users to the platform. For instance, the Dogecoin Foundation launched a successful digital marketing campaign titled “Dogecoin Millionaire” in 2021, resulting in increased awareness of Dogecoin and an expanded user base.

Similarly, Coinbase ran a successful campaign in 2020 named “Bitcoin for Beginners,” which was successful in educating users about Bitcoin and increasing its user base.

Referral and Affiliate Programs

Referral and affiliate programs incentivize existing users to promote the exchange and bring in new users. Users receive a commission or reward for referring new users to the exchange, generally a percentage of the trading fees paid by the new user.

Popular referral and affiliate programs for Bitcoin exchange platforms include:

- Binance affiliate program

- Coinbase affiliate program

- Coinmama affiliate program

- Changelly affiliate program

- CEX.IO affiliate program

Ongoing Operational Expenses

Ongoing operational expenses, such as platform maintenance, customer support, and updates and feature enhancements, are important considerations for the overall cost of running a Bitcoin exchange platform. Ensuring the smooth functioning of the platform and addressing any technical issues that may arise are essential for maintaining user satisfaction and trust in the platform.

It is important to consider the cost of these operational expenses when evaluating the total cost of running.

Platform Maintenance

Regular platform maintenance ensures smooth functioning and addresses any technical issues that may arise. Preventive and corrective maintenance are the two primary types of maintenance available. Preventive maintenance involves regularly inspecting the platform for potential issues and resolving them before they become a problem, while corrective maintenance involves rectifying any issues that emerge after the platform has been launched.

Costs associated with platform maintenance include hosting fees, server maintenance, and software updates.

Customer Support

Providing responsive customer support is crucial for maintaining user satisfaction and trust in the platform. Offering various customer support options can help address users’ questions and concerns, including:

- Live chat

- Phone

- Social media support

The costs associated with customer support include offering technical assistance, responding to customer inquiries, and resolving customer complaints.

Updates and Feature Enhancements

Regular updates and feature enhancements help keep the platform competitive and relevant in the ever-evolving cryptocurrency market. The costs for updates and feature enhancements include bug fixes, feature additions, and security patches.

Staying up-to-date with the latest features and improvements ensures that the platform remains secure and compliant with the most recent regulations.

Cost-Effective Alternatives: White Label Solutions and Clone Scripts

Cost-effective alternatives to building a Bitcoin exchange from scratch include white label solutions and clone scripts. These options offer pre-built, customizable exchange platforms that can be branded and launched quickly, saving time and resources compared to custom development.

White label solutions provide a ready-made platform that can be customized with a company’s branding.

White Label Solutions

White label solutions provide pre-built, customizable exchange platforms that can be easily branded and launched in a timely manner. They offer a cost-efficient approach to swiftly launching a Bitcoin exchange, as they are pre-constructed and require minimal customization.

The main disadvantage of white label solutions is that they are not as flexible as custom-built solutions, thus potentially unable to meet the user’s exact requirements and may not scale as rapidly as custom-built solutions.

Kyrrex White Label, however, offers the best of both worlds: a turnkey solution designed to cater to the fluctuating demands of different clients. Whether what's required is a small OTC platform to serve local needs or a medium-sized crypto exchange intended to attract a more varied user base, Kyrrex White Label has something for everyone. The platform also offers unlimited liquidity to clients via its Liquidity Hub and experienced legal assistance in securing a cryptocurrency licence from regulators.

Clone Scripts

Clone scripts are pre-built exchange platforms modelled after popular exchanges, providing a cost-effective and time-efficient solution for establishing a Bitcoin exchange. The expense of utilizing clone scripts is contingent upon the features and customization needed, generally ranging from $5,000 to $20,000.

By choosing clone scripts, developers can focus on other aspects of the platform, such as user interface and marketing strategies.

Summary

In conclusion, the cost of creating a Bitcoin exchange depends on various factors, including development costs, security measures, licensing and compliance requirements, and ongoing operational expenses. Utilizing cost-effective alternatives like crypto white label solutions and clone scripts can save time and resources, allowing you to focus on other aspects of the platform, such as user interface and marketing strategies. By carefully considering all these factors and making informed decisions, you can build a successful Bitcoin exchange platform that meets the needs of your users and thrives in the ever-evolving cryptocurrency market.

Frequently Asked Questions

How much does it cost to make your own crypto exchange?

Developing a cryptocurrency exchange platform can range from $50,000 to $98,000 for basic features. For a website and app, the cost can be anywhere from $132,000 to $145,000.

Depending on the platform’s size and model, the cost could even exceed $300,000.

What are the fees for Bitcoin exchanges?

The trading fee for Bitcoin exchanges usually starts at 0.10% for takers and 0.080% for makers, and can decrease to as low as 0.020% for takers and -0.005% for makers depending on the trading volume and OKB held.

For BTC/USD exchanges, a substantial fee between 0.1% and 6.0% is generally included.

How much does a white label exchange cost?

The cost of developing a White Label Crypto Exchange can range from $40,000 to $60,000.

Consider hiring a business like Kyrrex with expertise in the development process for an accurate price estimate.

Why is crypto crashing?

Rising U.S. bond yields, a hawkish FOMC stance, and a strong U.S. dollar have contributed to the crypto market downturn.

The combination of these factors has caused a sharp decline in the prices of major cryptocurrencies, such as Bitcoin and Ethereum. Investors are now looking for ways to protect their investments and minimize their losses.

What are the key components of a Bitcoin exchange platform?

Key components of a Bitcoin exchange platform include a trading engine, user interface and experience, and wallet integration for a seamless experience.

The Road to Compliance: Obtaining Licenses for Crypto Exchanges

Cryptocurrency exchanges have gained significant popularity in recent years, providing individuals with a platform to trade digital assets. The crypto tracking site CoinGecko monitors more than 700 crypto exchanges in existence with a cumulative daily trading volume of more than $39 billion. However, operating a cryptocurrency exchange requires more than just technical expertise. It also involves obtaining the necessary licenses to ensure compliance with regulatory frameworks. In this article, we will explain the step-by-step process of obtaining licenses for operating a cryptocurrency exchange, providing insider tips and expert advice along the way.

The Steps to Compliance

A recent study by the Atlantic Council revealed that 37 of the 45 countries reviewed have some form of crypto regulation in place. This speaks to the need to ensure compliance with local laws when setting up shop.

There is no single universal method that works for all compliance scenarios. Even so, these steps, broadly speaking, cover the usual process for acquiring a cryptocurrency license for your business.

1. Understand the Regulatory Landscape

Before embarking on the journey of obtaining licenses for your cryptocurrency exchange, it is crucial to understand the regulatory landscape in your target market. Different countries have varying regulations and licensing requirements for cryptocurrency exchanges. Conduct thorough research to identify the specific licenses needed and the regulatory bodies responsible for issuing them.

2. Define Your Business Model

Once you have a clear understanding of the regulatory requirements, it's time to define your business model. Determine the scope of services you plan to offer, such as trading cryptocurrencies, facilitating fiat-to-crypto transactions, or providing additional services like wallet solutions or Telegram bots. This step is essential as it will help you identify the specific licenses you need to obtain.

3. Prepare a Comprehensive Business Plan

A well-prepared business plan is crucial when applying for licenses. It demonstrates your understanding of the market, your business model, and your commitment to compliance. Your business plan should include details about your target audience, marketing strategies, financial projections, and risk management procedures. It should also highlight how you plan to implement robust security measures to protect your users' assets.

4. Establish a Legal Entity

To operate a cryptocurrency exchange, you will need to establish a legal entity. This could be a corporation, limited liability company (LLC), or any other legal structure recognized in your jurisdiction. Consult with legal professionals to determine the most suitable entity for your business, taking into consideration factors such as liability protection and tax implications.

5. Obtain the Necessary Licenses

With your business plan and legal entity in place, it's time to start the cryptocurrency license application process. The specific licenses required may vary depending on your jurisdiction, but common licenses include money transmitter licenses, digital asset exchange licenses, and anti-money laundering (AML) licenses. Each license will have its own set of requirements, such as minimum capital requirements, background checks, and compliance procedures. Ensure that you fulfill all the necessary criteria and provide all the required documentation.

6. Implement Robust Compliance Procedures

Compliance is a critical aspect of operating a cryptocurrency exchange. Implementing robust compliance procedures will not only help you obtain licenses but also ensure the security and trustworthiness of your platform. Develop and document policies and procedures for customer due diligence, transaction monitoring, and reporting suspicious activities. Regularly review and update these procedures to stay in line with evolving regulatory requirements. You can also outsource your compliance protocol to a trusted partner like Kyrrex that offers an all-encompassing support for your crypto compliance journey.

7. Engage with Regulatory Authorities

Throughout the license application process, it is essential to maintain open lines of communication with the regulatory authorities. Seek guidance from them whenever needed and address any concerns they may have promptly. Demonstrating your willingness to comply and work collaboratively with the regulators can significantly enhance your chances of obtaining licenses.

8. Partner with Compliance Experts

Navigating the complex world of regulatory compliance can be challenging, especially for startups and small businesses. Consider partnering with compliance experts like Kyrrex who specialize in the cryptocurrency industry. With Kyrrex, you gain access to a wealth of technical documentation, real-world examples, and a proven track record in obtaining licenses for various exchange platforms. These professionals can provide valuable insights, help you streamline your compliance procedures, and increase your chances of obtaining licenses.

The Journey After Compliance

Compliance in the cryptocurrency space doesn't end with getting the licenses your crypto platform needs. In this dynamic industry, nothing stands still and everything evolves on a constant basis. Official attitudes towards your business can swing in any direction, new laws can get created and old ones amended. It's important to implement certain processes to ensure your business remains on the right side of developments.

1. Stay Updated with Regulatory Changes

The regulatory landscape surrounding cryptocurrency exchanges is constantly evolving. It is crucial to stay updated with any changes in regulations that may impact your licensing requirements. Subscribe to industry newsletters like Coindesk, join relevant forums, and attend conferences to stay informed about the latest developments. Being proactive in understanding and adapting to regulatory changes will help you maintain compliance and avoid any potential penalties or legal issues.

2. Conduct Regular Audits and Assessments

Once you have obtained the necessary licenses, your compliance journey doesn't end there. It is essential to conduct regular audits and assessments to ensure ongoing compliance with regulatory requirements. Regularly review your policies, procedures, and security measures to identify any gaps or areas for improvement. Engage with third-party auditors or compliance consultants to conduct independent assessments and provide recommendations for enhancing your compliance framework.

3. Build Trust and Transparency

Building trust and transparency is crucial for the success of your cryptocurrency exchange. Communicate your commitment to compliance and security to your users. Implement measures to protect user data and funds, such as multi-factor authentication, cold storage for cryptocurrencies, and regular security audits. Being transparent about your compliance efforts and security measures will help build trust with your users and attract more customers to your platform.

4. Leverage Marketing Strategies

Obtaining licenses for your cryptocurrency exchange is not just about compliance; it is also an opportunity to differentiate yourself from competitors. Develop marketing strategies that highlight your compliance efforts and the security measures you have in place. Educate your target audience about the importance of using licensed exchanges and the benefits of trading on a compliant platform. Leverage social media, content marketing, and influencer partnerships to reach a wider audience and build brand awareness.

5. Foster Partnerships and Collaborations

Collaborating with other players in the cryptocurrency industry can be mutually beneficial. Partner with reputable financial institutions, payment processors, and technology providers to enhance the services you offer. These partnerships can not only help you expand your customer base but also strengthen your compliance framework by leveraging the expertise and resources of your partners.

6. Monitor and Analyze Key Metrics

Data-driven decision-making is essential in the world of cryptocurrency. Monitor and analyze key metrics related to your licensing efforts and compliance procedures. Track the number of license applications submitted, the time taken for approval, and any feedback received from regulatory authorities. Additionally, monitor user engagement, trading volumes, and customer satisfaction to assess the impact of your compliance efforts on your business performance. Use these insights to refine your strategies and improve your overall operations.

Conclusion

Obtaining license for cryptocurrency exchange is a crucial step towards building a reputable and compliant business. By understanding the regulatory landscape, defining your business model, preparing a comprehensive business plan, establishing a legal entity, and implementing robust compliance procedures, you can navigate the licensing process successfully. Remember to engage with regulatory authorities and seek expert advice when needed. With the right approach and dedication to compliance, you can pave the way for a successful cryptocurrency exchange that meets the highest standards of legality and security.

KYC Providers vs. In-House KYC: Pros and Cons for Crypto Exchanges

KYC procedures involve collecting and verifying personal information from customers to establish their identity and ensure that they are not engaging in illicit activities. Exchanges need to comply with regulatory requirements, which vary from country to country. To meet these obligations, they can either rely on third-party KYC providers or develop their own in-house KYC systems. Both options have their own set of advantages and disadvantages, which we will explore in the following sections.

KYC Providers: Advantages and Disadvantages

Using third-party KYC providers is a popular choice for many crypto exchanges. These providers specialize in verifying customer identities and complying with regulatory guidelines. Here are some advantages and disadvantages of using KYC providers:

Advantages:

- Expertise and Experience: KYC providers have dedicated teams with expertise in identity verification and compliance. They keep up with the latest regulations and industry best practices, ensuring that the exchange remains compliant.

- Efficiency: KYC providers have established processes in place, allowing for swift verification and onboarding of customers. This saves time and resources for the exchange.

- Cost-Effective: Outsourcing KYC procedures to a third-party provider can be cost-effective for smaller exchanges that lack the resources to develop their own in-house system.

Disadvantages:

- Limited Control: When relying on a third-party KYC provider, the exchange has limited control over the verification process. Any issues or delays may impact the customer experience and the exchange’s reputation.

- Dependency: Exchanges relying on KYC providers are dependent on their services. If the provider faces technical issues or goes out of business, it can disrupt the exchange’s operations.

In-House KYC: Advantages and Disadvantages

Developing an in-house KYC system gives exchanges full control over the verification process. They can tailor it to their specific needs and ensure compliance. However, there are also some drawbacks to consider:

Advantages:

- Customization: Creating an in-house KYC system allows exchanges to customize the verification process according to their specific requirements. This flexibility ensures that the system aligns perfectly with the exchange’s policies.

- Control: With an in-house KYC system, exchanges have complete control over the verification process. They can implement additional security measures and adapt the process as regulations change.

- Brand Confidence: By handling the KYC process internally, exchanges can build customer trust and confidence in their brand. Customers may perceive in-house systems as more secure and reliable.

Disadvantages:

- Resource-Intensive: Developing and maintaining an in-house KYC system requires significant resources, including technical expertise, personnel, and ongoing maintenance.

- Compliance Risks: Building an in-house KYC system means that the exchange assumes full responsibility for compliance. This can be challenging, considering the ever-changing regulatory environment.

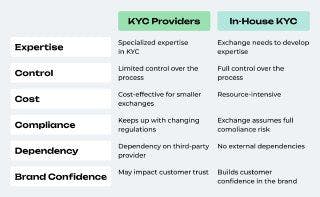

Comparison of KYC Providers and In-House KYC

To have a clear understanding of the pros and cons, let’s compare KYC providers and in-house KYC in a table-format:

Factors that Influence Choice of KYC System

The choice between KYC providers and in-house KYC depends on factors such as the exchange’s size, budget, regulatory environment, and long-term goals. Exchanges need to carefully assess their specific needs and weigh the pros and cons before making a decision. Let's consider these in more detail:

Exchange Size

The size of a crypto exchange plays a significant role in determining the choice between using KYC providers or an in-house KYC solution. Larger exchanges, handling a high volume of users and transactions, might find it more efficient to partner with established KYC providers. These providers offer scalable solutions and expertise in managing a large number of verifications swiftly. Smaller exchanges, on the other hand, could consider an in-house KYC approach if their user base is manageable, as it provides more control and customization over the process.

Budget

The financial resources available to an exchange are a crucial factor in this decision. Partnering with external KYC providers often involves costs, including licensing fees and per-verification charges. On the other hand, setting up an in-house KYC system requires initial investment in technology, personnel, and ongoing maintenance. Exchanges must balance the cost of outsourcing with the potential benefits of maintaining direct control over their KYC process.

Regulatory Environment

Compliance with regulatory standards is paramount in the cryptocurrency space. The regulatory environment of the exchange's operating jurisdiction greatly influences the choice between KYC providers and in-house solutions. Some jurisdictions might have strict requirements that necessitate close collaboration with specialized providers to ensure compliance. In contrast, more lenient regulations might allow exchanges to implement their own processes in-house.

Long-Term Goals

A crypto exchange's long-term goals shape its strategic decisions, including how it handles KYC. Exchanges aspiring for rapid growth might opt for KYC providers due to their scalability and speed. On the other hand, exchanges aiming for unique customer experiences or a specific branding might lean towards in-house KYC, as it offers greater customization and control. Long-term plans could also factor in the potential to integrate KYC data with other services or applications, influencing the choice between external providers and internal solutions.

Geographic Reach

If an exchange serves a diverse international user base, it might need to work with KYC providers that can cater to different regions' compliance requirements and language preferences.

User Experience

The ease and convenience of the KYC process for users can significantly impact their perception of the exchange. Depending on the target audience and user preferences, exchanges might opt for a solution that offers a smoother and more user-friendly onboarding experience.

Speed of Implementation

Time-to-market can be crucial, especially in a competitive industry like cryptocurrencies. Exchanges might choose a solution that can be quickly integrated and deployed to meet immediate compliance requirements.

Scalability

If an exchange anticipates rapid growth or fluctuating user volumes, scalability becomes a vital consideration. KYC providers often offer the advantage of handling large-scale verifications efficiently.

Operational Expertise

Some exchanges might lack the necessary expertise to set up and manage an in-house KYC system effectively. In such cases, partnering with a specialized provider could be a more viable option.

Conclusion