#OTC EXCHANGE

How to Start a Crypto Business: A Step-By-Step Guide

Are you ready to ride the wave of the booming crypto market and start your own business in this lucrative industry? With the potential for high returns and the ever-growing adoption of digital assets, now is the perfect time to dive into the world of cryptocurrencies. In this step-by-step guide, we will walk you through everything you need to know on how to start a crypto business in 2023-2024.. From understanding market trends to navigating legal and regulatory compliance, we’ve got you covered!

Short Summary

- Gain an understanding of the crypto market to make informed decisions and succeed.

- Monitor trends, understand different types of cryptocurrencies, and choose the right business idea for success in 2023, beginning of 2024.

- Ensure legal compliance & set up secure infrastructure with payment processing systems & customer support for growth opportunities.

Understanding the Crypto Market

Before you embark on your entrepreneurial journey, it is crucial to understand the crypto market and its intricacies. Knowledge of market trends, volatility, and types of cryptocurrencies is essential for making informed decisions and identifying potential risks associated with investing in digital assets.

Moreover, by differentiating your products or services from the competition, you can shape the competitive landscape and communicate unique value to potential customers.

Market Trends and Volatility

Financial history teaches us that market trends and volatility can provide valuable insights into the current state of the crypto market, helping investors and financial institutions make smart decisions. By staying informed about exciting crypto market trends, you position yourself to capitalize on opportunities that arise.

So, why is it important to monitor market trends and volatility? Simple – it enables you to make more informed decisions, better prepare for potential risks, and stay ahead of the competition.

Types of Cryptocurrencies

The world of cryptocurrencies is vast and diverse. Bitcoin, Ethereum, and altcoins are some of the most popular and exciting digital currencies that can be integrated into various business models in the crypto industry. As the first decentralized digital currency, Bitcoin has revolutionized the financial world and attracted the attention of other financial institutions looking to explore the potential of cryptocurrencies.

Ethereum, on the other hand, is a powerful blockchain-based platform that allows developers to build and launch innovative decentralized applications, opening up a world of possibilities for businesses. Lastly, altcoins are alternative cryptocurrencies that leverage the same blockchain technology as Bitcoin, providing secure and efficient ways to make payments and store value.

Understanding these different types of cryptocurrencies is key to identifying the most suitable crypto business idea for you.

Choosing the Right Crypto Business Idea

Now that you have a solid understanding of the crypto market, it’s time to explore various business ideas and opportunities that you can pursue in 2023. Here are some examples:

- Crypto trading platform

- Crypto wallet services

- Blockchain development services

- Crypto hardware businesses

- Shipment tracking using blockchain technology

- Crypto consulting services

- Crypto mining operations

- Crypto payment solutions

- Crypto investment funds

- Crypto education and training programs

Keep in mind that the potential of each business idea will vary, so it’s essential to consider your unique skills, resources, and target customer base when selecting the right crypto business for you. Let's talk about the first three:

Crypto Trading Platform

Starting a cryptocurrency trading platform can be an exciting and potentially lucrative venture. With the right platform, you can provide users with a secure and user-friendly way to buy and sell digital currencies. To ensure the success of your trading platform, it’s crucial to implement security measures such as two-factor authentication, cold storage, and encryption to safeguard user funds.

Additionally, focusing on creating an intuitive and easy-to-use platform will enhance the user experience and attract more customers to your platform. Lastly, staying compliant with all applicable laws and regulations is essential to guarantee success and avoid any potential legal issues.

Crypto Wallet Service

Another exciting opportunity in the crypto space is starting a crypto wallet service. Wallets provide users with a secure and user-friendly way to store and manage their digital assets. To ensure the success of your wallet service, it’s crucial to focus on security and user-friendliness. Implementing features such as multi-signature authentication, two-factor authentication, and secure storage of private keys will help protect your users and their assets.

By offering a safe and convenient way to store and manage digital assets, you can tap into the growing crypto market and attract a loyal user base.

Blockchain Development Services

With the increasing demand for blockchain technology, starting a blockchain development company can be a fantastic opportunity for tech-savvy entrepreneurs. By offering cutting-edge blockchain development services, you can help businesses unlock the full potential of this revolutionary technology. Blockchain development services can be tailored to various industries, such as finance, healthcare, and supply chain management, providing ample opportunities for growth and expansion.

By staying up-to-date with the latest blockchain innovations and forming strategic partnerships, you can ensure the success and growth of your blockchain development business.

Legal and Regulatory Compliance

Before diving into the world of crypto entrepreneurship, it’s essential to understand the legal and regulatory landscape to ensure the success of your business. Complying with applicable laws and regulations is crucial for staying ahead of the game and avoiding potential penalties or fines.

In this section, we will discuss the process of registering your business and understanding crypto regulations.

Registering Your Business

To start your crypto business, you will need to:

- Register it with the appropriate authorities.

- Decide on a legal business structure, such as a sole proprietorship or limited liability company (LLC), which will impact your tax filing and personal liability.

- Obtain the necessary business license and permits to ensure the legality of your business operations.

Lastly, you may want to consider obtaining an employer identification number (EIN) to help keep your personal and business taxes separate, especially if you have employees. Additionally, be aware of any applicable sales tax regulations in your area.

Understanding Crypto Regulations

Navigating the complex regulatory landscape of the crypto industry can be challenging, but it’s essential to stay updated with changes in regulations to ensure compliance and avoid potential fines. Here are some steps you can take to stay on top of the latest regulations and ensure the success of your crypto business.

- Familiarize yourself with the laws and regulations in your jurisdiction.

- Consult with a lawyer who specializes in crypto regulations.

- Use regulatory compliance solutions to automate compliance processes and stay updated with regulatory changes.

If you decide to use a solution to fast-track the process, it is important to look at a platform like Kyrrex White Label which offers a comprehensive package of ready-to-use solutions on top of expertise in navigating crypto compliance. You can leave all the hard work of developing a crypto exchange or OTC platform, as well as the starting liquidity, to experts while also getting professional guidance in securing regulatory approval for your business.

By following these steps, you can navigate the regulatory landscape more effectively and ensure that your crypto business operates within the legal framework.

Setting Up Your Crypto Business Infrastructure

Now that you’ve considered the legal and regulatory aspects, it’s time to set up your crypto business infrastructure. This involves implementing technology and security measures, setting up payment processing systems, and providing top-notch customer support.

By investing in these essential components, you can ensure the success and growth of your crypto business.

1- Technology and Security

Investing in robust technology and security measures is critical for safeguarding your crypto business and its users. Implementing advanced technologies like blockchain, decentralized finance (DeFi), and cryptocurrency platforms can help take your business to the next level.

Additionally, it’s essential to prioritize security by implementing measures such as two-factor authentication, encryption, and secure storage of data to protect your users and their assets.

2- Payment Processing

A reliable payment processing system is crucial for handling customer payments in both cryptocurrencies and fiat currencies. By setting up a secure and efficient payment processing system, you can provide your customers with a seamless experience when making transactions, ultimately leading to increased sales and customer retention.

Additionally, to help your business run smoothly, you should:

- Research and select the best payment processor for your business needs

- Set up business bank accounts, including a business bank account and a merchant account

- Integrate the payment processor with your website

- Ensure security and regulatory compliance

3- Customer Support

Providing excellent customer support is essential for building trust and maintaining a positive reputation in the crypto industry. Here are some strategies to achieve this:

- Respond promptly to customer inquiries and concerns.

- Create relevant content that addresses common customer questions and concerns.

- Offer incentives for customers to engage with your business, such as discounts or rewards. By implementing these strategies, you can foster brand loyalty and trust, resulting in increased sales and customer retention.

Additionally, outsourcing customer support to specialized blockchain companies can help you save time and resources while ensuring the highest level of support for your customers.

Marketing Your Crypto Business

Promoting your crypto business is crucial for attracting customers and driving sales. In this section, we will explore various marketing strategies, including building a strong online presence, leveraging social media marketing, and forming strategic partnerships to expand your reach and grow your business.

1- Building a Strong Online Presence

A professional website is the foundation of your online presence, and investing in search engine optimization (SEO) and content marketing can help attract more visitors to your site. By creating a visually appealing and user-friendly website, you can showcase your professional services, products, and build credibility and trust with potential customers.

Furthermore, engaging in SEO and content marketing strategies can drive organic traffic to your site, ultimately leading to increased sales and customer retention.

2- Social Media Marketing

Social media platforms offer a powerful way to promote your crypto business and engage with potential customers. By creating compelling content, leveraging hashtags, and collaborating with influencers, you can expand your reach and attract more customers to your business.

Additionally, engaging with potential customers on social media platforms can help build relationships, gather valuable feedback, and refine your product or service offerings.

3- Networking and Partnerships

Forming strategic partnerships and networking within the crypto community can greatly benefit your business by:

- Opening up new opportunities

- Expanding your reach

- Building meaningful relationships

- Gaining valuable insights

- Collaborating with other businesses

- Tapping into new markets

- Increasing your customer base

Additionally, networking events and industry conferences can provide valuable opportunities to connect with other professionals in the crypto space, fostering collaboration and growth.

Managing and Growing Your Crypto Business

Running a successful crypto business requires continuous improvement and adaptability to stay ahead in the ever-evolving landscape. In this section, we will provide tips and best practices for managing and growing your crypto business. This includes monitoring market trends, diversifying revenue streams, and embracing continuous improvement.

By monitoring market trends, you can stay ahead of the competition and identify opportunities for growth.

1- Monitoring Market Trends and Innovations

Staying updated with market trends and innovations is essential for remaining competitive in the crypto industry. By closely monitoring market trends, you can seize opportunities and gain a competitive edge in the industry. Additionally, utilizing technical analysis and chart patterns can help you make informed decisions about when to buy and sell, maximizing your returns.

Engaging with your community and staying informed on industry news can also help you stay ahead of the curve and ensure the success of your crypto business.

2- Diversifying Revenue Streams

Diversifying your revenue streams is a smart strategy for reducing risk and boosting profits, as many business owners, including small business owners, have discovered. Offering additional services or expanding into new markets can help you tap into new opportunities and grow your business. Adapting your business model and creating a solid business plan to include these strategies can lead to success.

By exploring market trends, keeping an eye on competitors, and staying informed on industry news, you can uncover fresh opportunities to diversify your revenue streams and ensure the long-term success of your crypto business.

3- Continuous Improvement and Adaptability

In the fast-paced world of cryptocurrencies, continuous improvement and adaptability are crucial for staying competitive. Here are some strategies to ensure the success and growth of your crypto business:

- Focus on community development

- Seek strategic alliances

- Set realistic expectations

- Regularly analyze key performance indicators (KPIs)

By implementing these strategies, you can stay ahead in the crypto industry.

Summary

In conclusion, starting a successful crypto business in 2023 requires a deep understanding of the crypto market, careful consideration of your business idea, and the ability to navigate the complex legal and regulatory landscape. By investing in robust technology and security measures, providing excellent customer support, and implementing effective marketing strategies, you can set your crypto business up for success. As the crypto industry continues to evolve and expand, staying adaptable and embracing continuous improvement will be crucial for staying ahead of the competition and achieving long-term success. So, are you ready to make your mark in the world of cryptocurrencies and build a thriving business? The time is now!

Frequently Asked Questions

Is crypto trading profitable 2023?

Cryptocurrency trading appears to be profitable in 2023, even with the extended market stagnation. Bitcoin and Ethereum continue to make steady gains while overall market trading volume shows no sign of cooling down. The market capitalization of the global cryptocurrency market has risen above $1 trillion and looks poised to continue its upward trend.

With the right strategies in place, crypto trading can be an incredibly profitable venture in 2023.

What crypto will grow in 2023 - 2024?

With the entire market anticipating greater regulatory clarity, and the Bitcoin halving also expected, it is safe to say the major layer-1 coins like Bitcoin, Ethereum, Solana, XRP, Stellar, Cardano, Polkadot and Radix; as well as exchange tokens like BNB, BASE and KRRX are likely to grow in 2023.

How do I start crypto in 2023 - 2024?

Start investing in crypto by opening an exchange account, depositing fiat currency, searching for and buying a coin like BTC or ETH, and holding it for the medium term.

Take advantage of the benefits and be aware of the associated risks.

Is crypto a good idea in 2023 - 2024?

2023 looks to be a promising year for crypto investments, with Bitcoin prices continuing to rise and more traditional financial firms increasing their adoption of the technology.

This makes it a great time for investors looking to diversify their portfolios and benefit from the potential growth of the crypto market.

What are some potential crypto business ideas to explore in 2023 - 2024?

For entrepreneurs looking to get into the crypto world in 2023, there are many exciting opportunities to explore, such as crypto hardware businesses, consulting, tax services, shipment tracking using blockchain, exchanges, mining, and Play to Earn games.

Crypto hardware businesses offer a great way to get involved in the industry, as they provide the necessary hardware and software to facilitate transactions. Consulting services can help entrepreneurs understand the complexities of the crypto world, while tax services can help them navigate the ever-changing regulations.

Shipment tracking using blockchain technology is also becoming a trend.

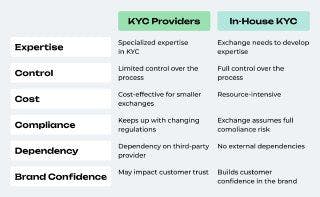

KYC Providers vs. In-House KYC: Pros and Cons for Crypto Exchanges

KYC procedures involve collecting and verifying personal information from customers to establish their identity and ensure that they are not engaging in illicit activities. Exchanges need to comply with regulatory requirements, which vary from country to country. To meet these obligations, they can either rely on third-party KYC providers or develop their own in-house KYC systems. Both options have their own set of advantages and disadvantages, which we will explore in the following sections.

KYC Providers: Advantages and Disadvantages

Using third-party KYC providers is a popular choice for many crypto exchanges. These providers specialize in verifying customer identities and complying with regulatory guidelines. Here are some advantages and disadvantages of using KYC providers:

Advantages:

- Expertise and Experience: KYC providers have dedicated teams with expertise in identity verification and compliance. They keep up with the latest regulations and industry best practices, ensuring that the exchange remains compliant.

- Efficiency: KYC providers have established processes in place, allowing for swift verification and onboarding of customers. This saves time and resources for the exchange.

- Cost-Effective: Outsourcing KYC procedures to a third-party provider can be cost-effective for smaller exchanges that lack the resources to develop their own in-house system.

Disadvantages:

- Limited Control: When relying on a third-party KYC provider, the exchange has limited control over the verification process. Any issues or delays may impact the customer experience and the exchange’s reputation.

- Dependency: Exchanges relying on KYC providers are dependent on their services. If the provider faces technical issues or goes out of business, it can disrupt the exchange’s operations.

In-House KYC: Advantages and Disadvantages

Developing an in-house KYC system gives exchanges full control over the verification process. They can tailor it to their specific needs and ensure compliance. However, there are also some drawbacks to consider:

Advantages:

- Customization: Creating an in-house KYC system allows exchanges to customize the verification process according to their specific requirements. This flexibility ensures that the system aligns perfectly with the exchange’s policies.

- Control: With an in-house KYC system, exchanges have complete control over the verification process. They can implement additional security measures and adapt the process as regulations change.

- Brand Confidence: By handling the KYC process internally, exchanges can build customer trust and confidence in their brand. Customers may perceive in-house systems as more secure and reliable.

Disadvantages:

- Resource-Intensive: Developing and maintaining an in-house KYC system requires significant resources, including technical expertise, personnel, and ongoing maintenance.

- Compliance Risks: Building an in-house KYC system means that the exchange assumes full responsibility for compliance. This can be challenging, considering the ever-changing regulatory environment.

Comparison of KYC Providers and In-House KYC

To have a clear understanding of the pros and cons, let’s compare KYC providers and in-house KYC in a table-format:

Factors that Influence Choice of KYC System

The choice between KYC providers and in-house KYC depends on factors such as the exchange’s size, budget, regulatory environment, and long-term goals. Exchanges need to carefully assess their specific needs and weigh the pros and cons before making a decision. Let's consider these in more detail:

Exchange Size

The size of a crypto exchange plays a significant role in determining the choice between using KYC providers or an in-house KYC solution. Larger exchanges, handling a high volume of users and transactions, might find it more efficient to partner with established KYC providers. These providers offer scalable solutions and expertise in managing a large number of verifications swiftly. Smaller exchanges, on the other hand, could consider an in-house KYC approach if their user base is manageable, as it provides more control and customization over the process.

Budget

The financial resources available to an exchange are a crucial factor in this decision. Partnering with external KYC providers often involves costs, including licensing fees and per-verification charges. On the other hand, setting up an in-house KYC system requires initial investment in technology, personnel, and ongoing maintenance. Exchanges must balance the cost of outsourcing with the potential benefits of maintaining direct control over their KYC process.

Regulatory Environment

Compliance with regulatory standards is paramount in the cryptocurrency space. The regulatory environment of the exchange's operating jurisdiction greatly influences the choice between KYC providers and in-house solutions. Some jurisdictions might have strict requirements that necessitate close collaboration with specialized providers to ensure compliance. In contrast, more lenient regulations might allow exchanges to implement their own processes in-house.

Long-Term Goals

A crypto exchange's long-term goals shape its strategic decisions, including how it handles KYC. Exchanges aspiring for rapid growth might opt for KYC providers due to their scalability and speed. On the other hand, exchanges aiming for unique customer experiences or a specific branding might lean towards in-house KYC, as it offers greater customization and control. Long-term plans could also factor in the potential to integrate KYC data with other services or applications, influencing the choice between external providers and internal solutions.

Geographic Reach

If an exchange serves a diverse international user base, it might need to work with KYC providers that can cater to different regions' compliance requirements and language preferences.

User Experience

The ease and convenience of the KYC process for users can significantly impact their perception of the exchange. Depending on the target audience and user preferences, exchanges might opt for a solution that offers a smoother and more user-friendly onboarding experience.

Speed of Implementation

Time-to-market can be crucial, especially in a competitive industry like cryptocurrencies. Exchanges might choose a solution that can be quickly integrated and deployed to meet immediate compliance requirements.

Scalability

If an exchange anticipates rapid growth or fluctuating user volumes, scalability becomes a vital consideration. KYC providers often offer the advantage of handling large-scale verifications efficiently.

Operational Expertise

Some exchanges might lack the necessary expertise to set up and manage an in-house KYC system effectively. In such cases, partnering with a specialized provider could be a more viable option.

Conclusion

KYC procedures are essential for ensuring the security and compliance of cryptocurrency exchanges. The choice between KYC providers and in-house KYC systems requires consideration of various factors. KYC providers offer expertise, efficiency, and cost-effectiveness, but come with limited control and dependency. On the other hand, in-house KYC offers customization, control, and brand confidence, but requires significant resources and assumes full compliance risk.

Each approach has its own set of advantages and disadvantages, and exchanges must carefully evaluate their needs and goals before deciding on the best approach to implement KYC procedures. By making an informed decision, exchanges can enhance their security measures and build customer trust.

Getting Licenses for Crypto Exchanges in 2023

Navigating the world of cryptocurrency exchanges can be a complex and challenging endeavor. With the rise of digital assets, ensuring compliance with the ever-evolving regulatory landscape has become crucial for the success and longevity of a crypto exchange. But how can one stay ahead of the curve and navigate the intricacies of obtaining the right licenses for crypto exchanges? Worry not, as this blog post will provide you with a comprehensive guide to help you understand the nuances of cryptocurrency exchange licenses, jurisdictions, and other essential regulatory considerations.

In the following sections, we will delve into the different types of licenses for crypto exchanges, the significance of choosing the right jurisdiction, the steps to obtain a crypto license, the regulations governing Virtual Asset Service Providers (VASPs) and Money Service Businesses (MSBs), and the impact of global regulations such as the upcoming Markets in Crypto-Assets (MiCA) regulation. Buckle up and let’s begin our journey!

Short Summary

- Understanding cryptocurrency exchange licenses is key for setting up a compliant and successful exchange.

- Establishing an crypto exchange in Estonia, Lithuania, or Switzerland can provide various advantages due to their favorable regulations.

- Obtaining a crypto license requires registration of legal entity, meeting KYC/AML regulations and adhering to international standards such as the Markets in Crypto-Assets (MiCA) regulation.

Understanding Cryptocurrency Exchange Licenses

Cryptocurrency exchanges must have a cryptocurrency license to legally operate. This authorization is granted by the government or financial regulator of the jurisdiction in which the exchange is based. Grasping the varieties of crypto licenses is essential for establishing a compliant and prosperous exchange. Obtaining a crypto exchange license offers a range of advantages, such as the avoidance of potential legal issues. In many jurisdictions, the types of financial licenses that can be applied for are not specifically designed to regulate the cryptocurrency market. Rather, they are general financial services licenses, where cryptocurrency exchange license activities may be included, such as licenses for brokers and financial advisors.

Now that we’ve established the significance of understanding cryptocurrency exchange licenses, it’s crucial to explore the different types of exchanges and their licensing requirements. The following sections will shed light on centralized and decentralized exchanges, and fiat vs. crypto-to-crypto exchanges.

Centralized vs. Decentralized Exchanges

The cryptocurrency market comprises two types of exchanges: centralized and decentralized. Centralized exchanges are platforms that facilitate the buying and selling of cryptocurrencies through an intermediary, while decentralized exchanges allow for direct peer-to-peer transactions without intermediaries. Centralized exchanges typically require licensing for payment services, while decentralized exchanges may or may not require licensing, depending on the applicable jurisdiction.

The licensing process for decentralized exchanges can vary depending on the applicable jurisdiction and the nature of cryptocurrency transactions. This distinction between centralized and decentralized exchanges plays a significant role in the licensing requirements for each type of exchange. Centralized exchanges necessitate strict adherence to licensing regulations to prevent potential legal issues and ensure compliance with regulatory bodies.

Fiat vs. Crypto-to-Crypto Exchanges

Another aspect to consider when understanding licensing requirements is the difference between fiat and crypto-to-crypto exchanges. Fiat exchanges, which facilitate transactions between fiat currency (such as USD or EUR) and cryptocurrencies, possess more rigorous crypto regulation and licensing requirements in comparison to crypto-to-crypto exchanges, which only deal with cryptocurrency transactions. Exchanges like Kyrrex, Kraken, and Coinbase offer fiat transactions and must adhere to regulations and monitor suspicious transactions.

After exploring the different types of exchanges and their respective licensing requirements, it’s now essential to discuss the importance of selecting the right jurisdiction for your crypto exchange.

Choosing the Right Jurisdiction for Your Crypto Exchange

When selecting a jurisdiction for a crypto exchange, factors such as taxes, regulations, and ease of doing business should be taken into consideration. In the European Union (EU), it is essential to take into account the regulatory specifics, conditions, and benefits of obtaining a crypto license in EU countries, as well as precisely defining the nature of the project and the services provided. Acquiring the European Crypto License permits businesses to operate legally within the EU, ensuring transparency and cultivating trust among customers, partners, and governmental authorities.

Jurisdictions can be broadly classified into two categories: favorable and challenging. Let’s explore these categories and their implications for your crypto exchange.

Favorable Jurisdictions

Estonia, Lithuania, and Switzerland are all conducive to the establishment of a cryptocurrency exchange, offering crypto-friendly regulations and tax environments. Estonia and Lithuania are widely regarded as crypto-friendly nations, with well-defined and comprehensive regulatory frameworks for cryptocurrency and blockchain-based businesses. Switzerland is recognized as a highly crypto-friendly nation, with a transparent and comprehensive regulatory framework for cryptocurrency and blockchain companies.

Establishing a crypto exchange in a beneficial offshore jurisdiction can provide various advantages, such as simpler setup, reduced overall taxes, clearer and more advantageous regulation, and more. Navigating these favorable jurisdictions can significantly impact the success and compliance of your crypto exchange.

Challenging Jurisdictions

On the other hand, some jurisdictions pose a challenge when establishing a crypto exchange. The United States is a particularly difficult jurisdiction when establishing a crypto exchange, due to higher taxes, tighter regulations, and potential obstacles from governing authorities such as the SEC. Other challenging jurisdictions include under-regulated countries, countries with stringent regulatory requirements, and locations where the notion of borders and jurisdictions is being contested.

Understanding the complexities of these challenging jurisdictions is essential for ensuring compliance and avoiding potential legal and financial pitfalls when operating a crypto exchange.

Obtaining a Crypto License: Key Steps and Requirements

The process of obtaining a license, specifically an Estonian crypto license, involves several key steps and requirements, including registering a legal entity, meeting KYC/AML requirements, and complying with local regulations. To register a legal entity for a crypto license, one must select a jurisdiction, register a legal entity, collect a package of documents, appoint a compliance officer and a responsible representative, and pay a state fee. The requirements may include authorized capital, legal form of business, reputation of owners, legal address, bank account, and adherence to AML/KYC regulations.

Let’s delve deeper into the essential steps of obtaining a crypto license, focusing on legal entity registration and KYC/AML compliance.

1- Legal Entity Registration

Legal entity registration is a necessity for obtaining a crypto license in most jurisdictions. The steps for legal entity registration for a crypto exchange involve incorporating a company and selecting a jurisdiction, procuring appropriate legal counsel, securing funding, acquiring a digital signature certificate (DSC), completing the registration application, and adhering to KYC requirements.

The initial step for legal entity registration for a crypto exchange is the incorporation of a company and selection of a jurisdiction. Subsequent steps include securing appropriate legal counsel and acquiring funding, obtaining a digital signature certificate (DSC), and completing the registration application while fulfilling Know Your Customer (KYC) requirements.

2- KYC and AML Compliance

KYC and AML compliance is pivotal for sustaining a crypto license and running a compliant exchange. Anti-Money Laundering (AML) requirements are measures and procedures aimed at identifying, preventing, and reporting money laundering and terrorist financing activities, ensuring the exchange is compliant with relevant laws and regulations, and safeguarding the exchange from potential financial crimes.

Failing to abide by AML regulations may result in the imposition of more severe penalties and sanctions. Ensuring compliance with KYC/AML regulations is an essential aspect of obtaining and maintaining a crypto license, protecting both the exchange and its users from potential legal and financial risks.

Virtual Asset Service Providers and Money Service Business Regulations

Virtual Asset Service Providers (VASPs) and Money Service Businesses (MSBs) are subject to specific regulatory requirements in various jurisdictions. VASPs are entities or individuals that offer services related to digital assets, such as exchanging, storing, selling, or transferring virtual assets on behalf of another person. Understanding the regulatory requirements for VASPs and MSBs is essential for operating a compliant crypto exchange.

Let’s explore the specific requirements and regulations for both VASPs and MSBs.

1- VASP Requirements

VASP requirements include registration, reporting, and compliance with international standards. These requirements have a direct impact on the operation and compliance of crypto exchanges, ensuring that exchanges adhere to the standards established by the Financial Action Task Force (FATF) and other regulatory bodies.

By understanding and complying with VASP requirements, crypto exchanges can avoid potential legal and financial risks, ensuring a smooth and compliant operation in the ever-evolving world of digital assets.

2- MSB Requirements

Money Service Businesses (MSBs) are subject to varying regulatory requirements depending on the jurisdiction. These requirements typically involve registration, reporting, and compliance with anti-money laundering regulations, ensuring that MSBs adhere to the regulations imposed by the Financial Crimes Enforcement Network (FinCEN) and other governing authorities.

By comprehending and adhering to MSB requirements, crypto exchanges can further safeguard their operations from potential legal and financial pitfalls, contributing to the overall compliance and stability of the exchange.

Navigating International Crypto Regulations

Understanding international crypto regulations is critical for ensuring compliance when operating a crypto business, such as an exchange, across multiple jurisdictions. The international regulations concerning cryptocurrency vary by country, with some countries having legalized cryptocurrency while others have partially or fully restricted it. Therefore, it is essential for businesses and individuals involved in cryptocurrency to comprehend and adhere to the regulations in their respective jurisdictions.

In this section, we will discuss the upcoming Markets in Crypto-Assets (MiCA) regulation and other international regulatory considerations that can impact the operation of a crypto exchange.

1- MiCA and Its Impact on Crypto Licensing

The upcoming MiCA regulation will standardize crypto licensing requirements across the EU, having an impact on exchanges operating within the region. The European Commission has developed MiCA, a regulatory framework, to address crypto assets and related services which have not been regulated by existing EU regulations. It is designed to regulate the markets for these assets in a safe and secure manner. The adoption of MiCA will directly affect companies wishing to operate in the EU, regardless of their customer base being outside the EU, requiring them to adhere to MiCA regulations and any additional requirements set by national regulatory frameworks.

With the projected implementation of MiCA between mid-2024 and early 2025, it is crucial for crypto exchanges operating in the EU to prepare for the harmonization of crypto licensing requirements and the potential impact on their operations.

2- Other International Regulatory Considerations

Apart from the MiCA regulation, other international regulatory considerations include understanding local laws and tax implications, as well as potential future changes in the regulatory landscape. Regulatory co-operation between different countries ensures that regulations are unified and effective, with organizations such as the World Trade Organization (WTO) establishing agreements and frameworks to govern international trade.

By staying abreast of international regulatory developments and understanding the potential impact on their operations, crypto exchanges can navigate the complexities of the global regulatory landscape and ensure long-term compliance and success.

Summary

In conclusion, understanding the nuances of cryptocurrency exchange licenses, jurisdictions, and international regulations is crucial for operating a compliant and successful exchange. By delving into the different types of licenses, choosing the right jurisdiction, and navigating the complexities of VASP and MSB regulations, crypto exchanges can ensure compliance and avoid potential legal and financial pitfalls.

As the world of digital assets continues to evolve, staying ahead of the curve by understanding and adhering to the ever-changing regulatory landscape is essential for the longevity and prosperity of a crypto exchange. With the knowledge gained from this comprehensive guide, you are now well-equipped to embark on the exciting journey of establishing and operating a compliant crypto exchange in the dynamic world of cryptocurrencies.

Frequently Asked Questions

How do I get a crypto exchange license?

To get a cryptocurrency exchange license, you must meet financial stability, cybersecurity and compliance requirements as outlined by the relevant laws in your jurisdiction.

These requirements vary from jurisdiction to jurisdiction, but typically include having a certain amount of capital, having a secure system for storing customer funds, and having a compliance program in place to ensure that the exchange is following all applicable laws.

What is the crypto exchange license in the UK?

The crypto exchange license in the UK is a registration with the FCA under the AML/CTF regime. This registration acts as a ‘license’, allowing for the provision of certain crypto services from within the UK.

What is a crypto license?

A crypto license is an important legal authorization that provides permission for a crypto business to conduct a cryptocurrency exchange and comply with applicable laws and regulations. It can also help to establish customer trust and expand services.

What are the key differences between centralized and decentralized exchanges?

Centralized exchanges involve a third-party intermediary to process transactions, while decentralized exchanges allow users to interact directly with one another without any intermediaries.

What factors should be considered when choosing a jurisdiction for a crypto exchange?

When selecting a jurisdiction for a crypto exchange, factors such as taxes, regulations, and ease of doing business must be taken into account.

These factors can have a significant impact on the success of the exchange, so it is important to choose a jurisdiction that is favorable to the business.

For example, some jurisdictions may have lower taxes or more levies.

A Step-by-Step Guide to Opening Your Own OTC Platform

Cryptocurrency trading is vast and varied, with diverse avenues for investment and transaction. One such promising avenue that has caught the attention of investors and entrepreneurs alike is Over-the-Counter (OTC) trading. Unlike traditional exchanges, OTC trading offers a more personalized and convenient way to privately trade large volumes of cryptocurrencies.

For businesses or individuals looking to delve into this vibrant sector, setting up an OTC trading platform can open up new revenue streams and cater to a growing segment of crypto traders seeking discretion and flexibility.

Requirements for Opening Your Own OTC Platform

Before embarking on the journey to establish your own OTC platform, it is essential to be aware of the requirements that can pave the way for a successful launch. These requirements range from a deep understanding of the cryptocurrency landscape to having a robust technical infrastructure and regulatory compliance.

A. Understanding the crypto landscape

At the heart of every successful OTC crypto exchange platform is a profound understanding of the cryptocurrency landscape. Knowing your market, audience, the latest trends, risks, and opportunities is crucial for creating a platform that appeals to your target users.

B. Technical infrastructure

Developing a cryptocurrency OTC exchange requires a robust technical infrastructure that can handle large transactions and provide a seamless user experience. It involves setting up a reliable server system, security measures, user-friendly interface, and efficient trade matching algorithms.

C. Regulatory compliance

Compliance with regulatory requirements is non-negotiable in the crypto world. This involves acquiring necessary licenses, adhering to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, and staying updated with the evolving regulatory landscape.

D. Liquidity management

Liquidity is key in the world of OTC trading. Having a strategy for liquidity management, whether it’s through market-making, partnering with liquidity providers, or integrating with a liquidity network, is vital for your platform's success.

E. Marketing and user acquisition strategy

Once your platform is up and running, attracting users and encouraging active trading is crucial. This requires a well-planned marketing and user acquisition strategy that effectively communicates the benefits of your platform to potential users.

These are the essential pillars that form the foundation of a successful OTC crypto exchange. Each of these requirements warrants careful consideration and strategic planning.

Kyrrex: Your Partner in OTC Trading Platform Development

Kyrrex presents an outstanding White Label crypto solution that serves as a reliable and proficient partner for launching your OTC crypto exchange platform. With an impressive track record, Kyrrex's expertise plays an instrumental role in successful market entry and the prosperous operation of your platform. Ensuring regulatory compliance across multiple jurisdictions, Kyrrex holds licenses that protect your platform and guarantee its legality.

In terms of technology, Kyrrex boasts a platform designed on modern multi service architecture, prepared to scale and evolve in tandem with your business. This innovative technology fosters a seamless and efficient trading experience for users. The security of Kyrrex's platform is another notable aspect, with enhanced Security & AML checks powered by strategic partnerships, like that with Chainalysis. This robust security infrastructure keeps your platform safe from unauthorized transactions and potential risks.

What sets Kyrrex apart is its exemplary customer support. Every client is provided with a personal manager, offering consistent assistance throughout the setup and operational process of the OTC crypto exchange. In choosing Kyrrex as your OTC trading platform provider, you're partnering with an entity synonymous with trust, reliability, and unparalleled excellence, thereby paving the way for your platform's undeniable success.

Step-by-Step Process to Open Your Own OTC Platform with Kyrrex

- Complete the application: start by filling out the application form for technical connection to Kyrrex's Liquidity Hub. It's important to ensure all information is accurate and complete for a smooth verification process.

- Undergo AML verification: after completing the application form, you'll need to undergo AML (Anti-Money Laundering) verification. This step is critical to ensure your platform aligns with legal requirements and best practices for the prevention of financial crimes.

- Technical setup: upon successful verification, Kyrrex provides all necessary technical documentation, keys, and data for implementation measures. This includes setting up a high-speed connection to partner exchange platforms. You'll also have the support of Kyrrex's technical team throughout this process.

- Make a security deposit: the final step involves making a security deposit to activate the ability of your clients to transact on the Liquidity Hub platform. This step essentially completes your integration with the Kyrrex system and your OTC platform is ready to operate.

Conclusion

Setting up your own OTC trading platform can be a daunting endeavor without the right partnership. The integration with Kyrrex makes this process not only straightforward but also secure and technically sound. The technical prowess, regulatory compliance, robust security measures, and dedicated customer support ensure that your platform is set up for success from the get-go.

The Profitability of White Label Solutions for OTC Exchanges

In the rapidly evolving world of digital currencies, one of the emerging trends that has gathered considerable momentum is Over-The-Counter (OTC) trading. In contrast to traditional trading methods, OTC exchanges allow investors to conduct direct trades off the open market, providing a more private, faster, and cost-effective alternative for large volume trades.

At the heart of this OTC revolution are White Label solutions — pre-packaged software solutions that enable businesses to launch their own branded OTC exchange platforms quickly and efficiently. These ready-to-go solutions offer a wealth of benefits, including reduced development time and cost, enhanced customization, and a swift market entry, making them a lucrative choice for entrepreneurs and businesses eager to carve their niche in the OTC market.

Understanding White Label Solutions

White Label solutions are essentially ready-made, customizable software products, sold under a license to businesses. These solutions allow companies to leverage the developer's technological expertise and infrastructure while enabling them to brand the product as their own. This arrangement not only eliminates the need for extensive and time-consuming software development but also drastically reduces the associated costs, making it a compelling strategy for businesses looking to hit the ground running.

In the context of OTC trading, White Label solutions offer a comprehensive suite of tools to facilitate the operation of an OTC exchange platform. They typically include features such as user-friendly interfaces, robust security protocols, a plethora of supported cryptocurrencies, and strong liquidity.

Furthermore, these solutions often come with the necessary legal framework, ensuring that businesses operate within the boundaries of the law. This combination of functionality, ease of use, and regulatory compliance makes White Label OTC trading platforms an attractive proposition for businesses, regardless of their size or technical expertise.

An example of the power and flexibility of White Label Solutions is the successful launch of the MONETA IN crypto exchange, powered by Kyrrex's White Label solution. The White Label solution provided a game-changing integration with multiple fiat currencies and seamless compatibility with Visa and MasterCard. This integration allowed MONETA IN users to buy cryptocurrencies directly using their cards, enhancing their trading experience significantly. Moreover, the wide range of crypto pairs and strong liquidity provided by the Kyrrex solution granted MONETA IN users unprecedented freedom and flexibility in their trading activities.

This successful use case highlights how White Label solutions can significantly reduce the time, effort, and financial investment needed to launch a thriving OTC trading platform. By embracing these solutions, businesses can shift their focus from dealing with technical complexities to refining their trading strategies and nurturing customer relationships.

The Rise of OTC Exchanges

In the realm of cryptocurrency trading, OTC exchanges have been a revelation, bringing forth a new paradigm that aligns with the evolving needs of investors. The recent surge in the popularity of these exchanges is primarily driven by their ability to facilitate large transactions without causing drastic price fluctuations in the open market. This characteristic makes OTC exchanges particularly attractive to high-volume traders, including institutional investors, hedge funds, and wealthy individuals.

Unlike traditional exchanges where orders are publicly visible on the order book, OTC trades are conducted privately. This ensures that large orders do not impact the market price significantly. Moreover, OTC exchanges allow for a greater degree of customization and flexibility in the execution of orders, which is not typically possible on traditional exchanges.

The demand for private, efficient, and flexible trading solutions has led to a proliferation of OTC exchanges in the cryptocurrency market. Consequently, there is a growing need for software solutions that can help businesses capitalize on this trend. This is where White Label Solutions come into the picture. They offer a quick and efficient way to establish an OTC trading platform, tailor-made to fit the unique needs of individual businesses.

Profiting from White Label OTC Exchanges

White Label OTC exchanges are not just tools for facilitating cryptocurrency trades, they can also be leveraged as robust revenue-generating machines. The following are some of the key ways businesses can profit from White Label OTC exchanges:

- Transaction fees: each trade that occurs on your platform will generate a transaction fee, providing a consistent stream of revenue. The more active traders you have on your platform, the higher your profits.

- Listing fees: you can charge a fee for listing new cryptocurrencies on your platform. As the number of cryptocurrencies continues to grow, so does the potential for earning listing fees.

- Withdrawal fees: users will typically pay a fee to withdraw their cryptocurrencies from your platform to their private wallets. This fee contributes to the overall profitability of the platform.

- Premium features: you can offer additional value-added services to your users for a fee. For example, you could offer advanced trading tools, in-depth market analysis, or priority customer service.

- Advertising: if your platform gains substantial traffic, you can sell advertising space to crypto-related businesses looking to reach your audience.

- Partnerships and affiliations: by partnering with other companies and influencers in the crypto space, you can generate additional income. This could involve commissions for referrals or revenue sharing agreements.

Investing in a White Label OTC exchange can be a strategic move with substantial revenue potential. It allows businesses to tap into the lucrative crypto market, providing a service that is in high demand while generating consistent returns.

Factors to Consider Before Adopting a White Label OTC Exchange

The prospect of launching a white label OTC crypto exchange can be exciting, but it's crucial to consider certain factors before making a decision. These considerations will ensure that your venture into the world of crypto trading is not just profitable but also sustainable.

- Regulatory compliance: as cryptocurrencies continue to become more mainstream, regulatory scrutiny is increasing. Make sure that your chosen White Label solution provider has a solid understanding of regulatory requirements in the jurisdictions you aim to operate.

- Security: in the world of digital assets, security is paramount. Look for a solution that employs the latest security protocols and technologies to protect user funds and data.

- Liquidity: the success of your exchange depends on liquidity. The more liquid an exchange is, the more attractive it is to traders. Ensure your white label crypto exchange solution provides you with ample liquidity.

- Customization: the ability to customize your platform according to your brand's image and to the specific needs of your target audience is vital. A good white label solution should offer comprehensive customization options.

- Scalability: as your user base grows, so will your need for a robust and scalable platform. Your chosen solution should be capable of growing with you, handling increased trading volumes without compromising on speed or performance.

- Support and maintenance: ongoing technical support is a crucial aspect of running a smooth and efficient exchange. Ensure your provider offers timely and efficient support.

Conclusion

Entering the world of crypto trading with your own white label OTC crypto exchange can be a game-changer, offering a promising and profitable business opportunity. However, it requires careful consideration and strategic planning. With the right partners and an in-depth understanding of the market, businesses can launch successful and profitable exchanges that stand out in the ever-growing crypto space.

Exploring the World of OTC Trading: A New Age for Your Crypto Business

Navigating the rapidly evolving landscape of the cryptocurrency industry, one cannot overlook the rising prominence of Over-The-Counter (OTC) trading. Operating outside the conventional framework of traditional exchanges, OTC trading has emerged as a powerful force, offering unique solutions to the inherent challenges of cryptocurrency trading.

Whether you're a seasoned trader or a budding entrepreneur, understanding OTC markets and integrating a robust crypto OTC trading platform could be the strategic move that revolutionizes your digital asset venture.

The Emergence of OTC Trading in Cryptocurrency

In the complex terrain of cryptocurrency, OTC trading has emerged as a prominent player, primarily due to its capacity to handle large volume trades without causing significant price fluctuations. Born out of necessity, OTC trading presents an alternative route for investors who seek to execute massive transactions without disrupting the delicate balance of the market.

OTC trading has witnessed exponential growth in the past few years, making it a significant aspect of the crypto industry. In a market that's defined by its volatility, the introduction of crypto OTC trading platforms has created a conducive environment for high-stake players to conduct their operations securely and efficiently. The birth and evolution of OTC markets in the digital asset ecosystem has shown the remarkable adaptability and resilience of the industry.

Trading OTC has become more than just a strategic move; it is rapidly becoming the norm for major players in the cryptocurrency market. From institutional investors to crypto whales, the use of a well-structured crypto OTC trading platform is now widely recognized as a crucial component of a successful trading strategy.

Understanding the Mechanism of OTC Trading

Navigating the path of OTC trading requires a thorough understanding of its unique mechanism. Unlike traditional exchanges where orders are made public on an order book, OTC trading takes place off the market. This ensures the transactions remain confidential, thereby preventing significant market movement, a paramount feature of high-volume trading.

In a typical OTC trading scenario, buyers and sellers negotiate directly or via a crypto OTC trading platform. These platforms serve as intermediaries, matching buy and sell orders. Notably, in OTC markets, the trade prices are not necessarily published, thereby providing a significant layer of privacy for all sides.

The Impact of OTC Trading on Your Cryptocurrency Business

The integration of an OTC trading platform into your cryptocurrency business can herald a new era of growth and success. As a strategy that operates outside traditional exchanges, OTC trading offers a plethora of benefits, the first of which is the capacity to handle large volume trades without significantly impacting the market.

The addition of OTC markets into your trading strategy presents an opportunity to maximize liquidity. For businesses dealing with large volumes of cryptocurrency, liquidity can often pose a challenge. However, through OTC trading, businesses can execute large trades swiftly and efficiently, significantly enhancing their liquidity position.

Moreover, OTC trading aids in minimizing slippage — a common issue encountered in traditional exchanges. Since trading OTC doesn't immediately reflect in the market, the risk of price slippage significantly decreases. This means you can carry out substantial transactions without the fear of drastically affecting the market price.

Adopting an OTC trading platform can transform the way you operate in the cryptocurrency space. For instance, some businesses have been able to expand their clientele by offering OTC trading services, thereby enhancing their market position.

Implementing OTC Trading: A Step-By-Step Guide

As the advantages of OTC trading become apparent, the next logical step is to explore its implementation in your cryptocurrency business. Here is a step-by-step guide to help you navigate this process:

Evaluation of your current business model

Before taking the leap into OTC trading, a comprehensive evaluation of your current business model is crucial. You need to assess the volume of transactions, the liquidity requirements, and the client base. If your business frequently handles large trades, or if you have clients that require significant liquidity, then integrating an OTC trading platform can provide significant advantages.

Identifying the right OTC trading platform for your needs

Choosing the right OTC trading platform can make a significant difference in the implementation process. Consider factors such as the platform's reputation, security measures, liquidity access, and the efficiency of their customer support. The platform should align with your business goals and cater to the needs of your client base.

Steps to integrate OTC trading into your business operations

- Set clear objectives: define what you aim to achieve with the integration of OTC trading. This could be to increase liquidity, enhance client satisfaction, or expand your services.

- Collaborate with the chosen platform: work closely with your chosen OTC trading platform to understand the integration process. They can provide guidance on how to efficiently incorporate the system into your operations.

- Train your team: ensure your team is well-equipped to handle the new system. This might involve training sessions or workshops conducted by the OTC trading platform.

- Announce the new service: once the system is integrated, announce the new service to your clients. This could be through newsletters, social media posts, or personalized emails.

- Monitor and adjust: monitor the system’s performance and be prepared to make necessary adjustments. Seek feedback from clients and use it to improve your services.

With careful planning and execution, the integration of OTC trading into your cryptocurrency business can be a smooth process. However, remember that the benefits you derive depend largely on the OTC trading platform you choose. Thus, it's crucial to align your business model with the right platform to ensure successful integration and performance.

Kyrrex's White Label Solution: Your Gateway to OTC Trading

Kyrrex's White Label Crypto OTC Trading Platform facilitates the launch of your crypto OTC exchange, enabling a variety of individuals and businesses to create new revenue streams.

What does Kyrrex offer?

Kyrrex's White Label solution is a fully customizable, turnkey solution. It provides unlimited liquidity, enhanced security through a partnership with Chainalysis, and user convenience via Visa & MasterCard support. Furthermore, its platform features ultra-fast engines and allows users to conveniently manage their digital assets.

Kyrrex's products, validated by industry partners and regulatory compliance, stand out for their excellence and reliability. They provide full legal support in acquiring OTC licenses, regardless of the jurisdiction.

Monetizing your platform

Kyrrex's monetization model is designed to attract users to your platform, encourage active trading, and generate revenue from transactions. You can set a commission fee structure for each transaction conducted on your OTC platform, leading to a stable monthly income.

Testimonials from happy customers

Successful collaborations with businesses such as MONETA IN and FLYPAY testify to the effectiveness and reliability of Kyrrex's White Label solution. Their clients appreciate the speed and efficiency of setting up their crypto exchanges, multi-fiat currency support, and the platform's ease of integration with Visa & MasterCard.

In conclusion, Kyrrex's White Label solution offers a comprehensive, secure, and reliable gateway into the OTC trading world. It provides an opportunity to enhance business operations, monetize your audience, and open a new, profitable avenue in the crypto market.